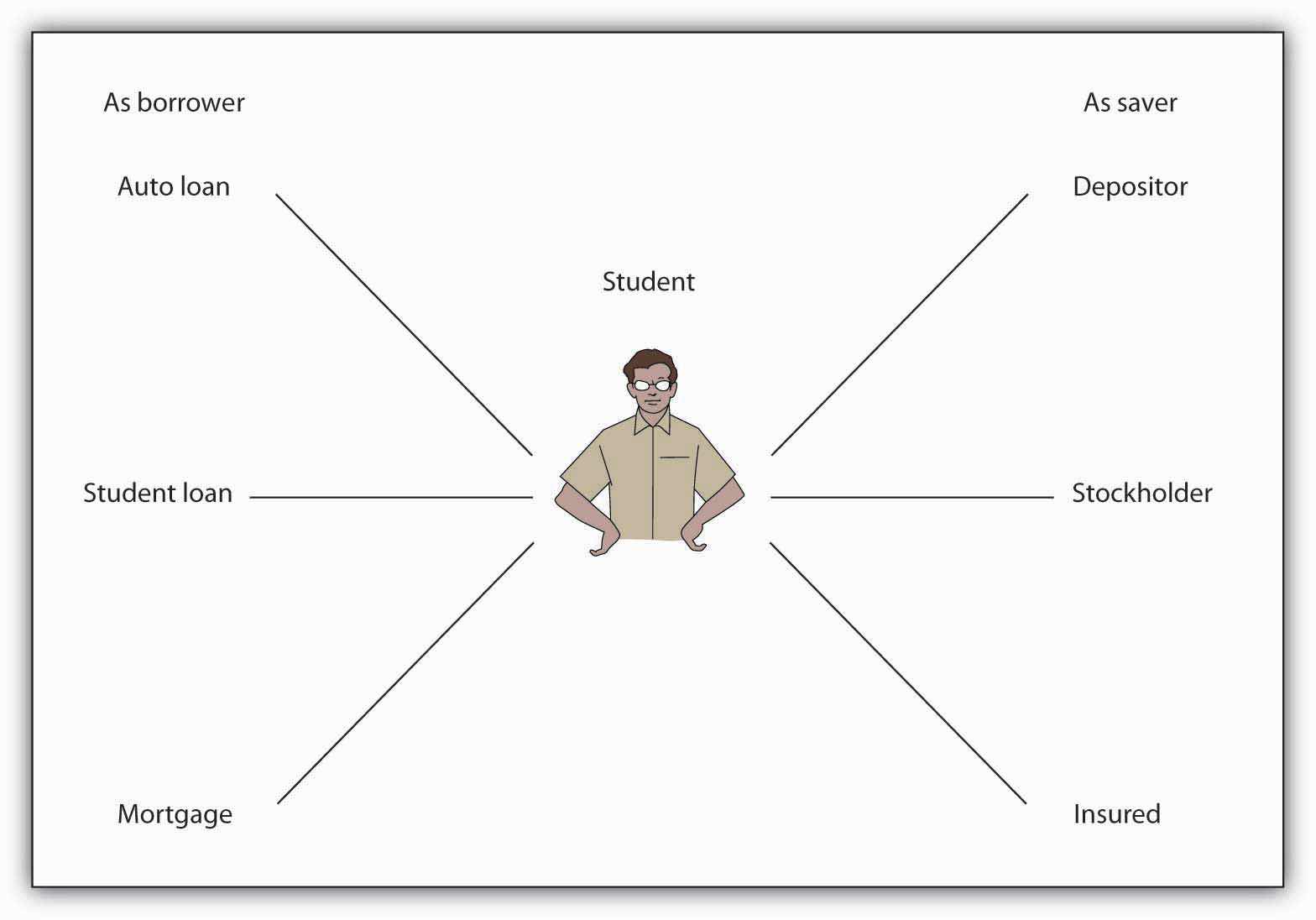

A financial systemA densely interconnected network of financial intermediaries, facilitators, and markets that allocates capital, shares risks, and facilitates intertemporal trade. is a densely interconnected network of intermediaries, facilitators, and markets that serves three major purposes: allocating capital, sharing risks, and facilitating all types of trade, including intertemporal exchange. That sounds mundane, even boring, but it isn’t once you understand how important it is to human welfare. The material progress and technological breakthroughs of the last two centuries, ranging from steam engines, cotton gins, and telegraphs, to automobiles, airplanes, and telephones, to computers, DNA splicing, and cell phones, would not have been possible without the financial system. Efficiently linking borrowers to lenders is the system’s main function. Borrowers include inventors, entrepreneurs, and other economic agents, like domestic households, governments, established businesses, and foreigners, with potentially profitable business ideas (positive net present value projectsA project likely to be profitable at a given interest rate after comparing the present values of both expenditures and revenues.) but limited financial resources (expenditures > revenues). Lenders or savers include domestic households, businesses, governments, and foreigners with excess funds (revenues > expenditures). The financial system also helps to link risk-averse entities called hedgers to risk-loving ones known as speculators. As Figure 2.1 "The financial system at work for you" illustrates, you are probably already deeply embedded in the financial system as both a borrower and a saver.

Figure 2.1 The financial system at work for you

Occasionally, people and companies, especially small businesses or ones that sell into rapidly growing markets, have enough wealth (a stock) and income (a flow) to implement their ideas without outside help by plowing back profits (aka internal financeFinancing that comes from the company itself, the plowing of profits back into the business.). Most of the time, however, people and firms with good ideas do not have the savings or cash needed to draw up blueprints, create prototypes, lease office or production space, pay employees, obtain permits and licenses, or suffer the myriad risks of bringing a new or improved good to market. Without savings, a rich uncle or close friend, or some other form of external financeObtaining short- or long-term funding from outside sources (those external to the company)., people remain wannabe entrepreneurs and companies cannot complete their projects. That should concern you because the world is a poorer place for it.www.innovation-america.org/archive.php?articleID=79 It should also concern you because many students need loans in order to afford college and thereby increase their future earnings.

Why do we need a financial system? Why can’t individuals and companies simply borrow from other individuals and companies when they need to? Lending, like supplying many other types of goods, is most efficiently and cheaply conducted by specialists, companies that do only one thing (or a couple of related activities) very well because they have much practice doing it and because they tap economies of scale. The fixed costs of making loans—advertising for borrowers, buying and maintaining computers, leasing suitable office space, writing up contracts, and the like—are fairly substantial. To recoup those fixed costs, to drive them toward insignificance, lenders have to do quite a volume of business. Little guys usually just can’t be profitable. This is not to say, however, that bigger is always better, only that to be efficient financial companies must exceed minimum efficient scaleThe smallest a business can be and still remain efficient and/or profitable..