Question: Some companies prefer to take a “top-down” approach to budgeting, in which upper management establishes the budget with little input from other employees. These budgets are imposed on the organization and do little to motivate employees or to gain acceptance by employees. What method of budgeting is more effective than the top-down approach?

Answer: Successful companies approach budgeting from the bottom up. This requires the involvement of various employees within the organization, not just upper management. Lower-level employees often know more about their functional areas than upper management, and they can be an excellent source of information for budgeting purposes. Although getting input from employees throughout the organization can be time consuming, this approach tends to increase employee motivation and acceptance of the budget.

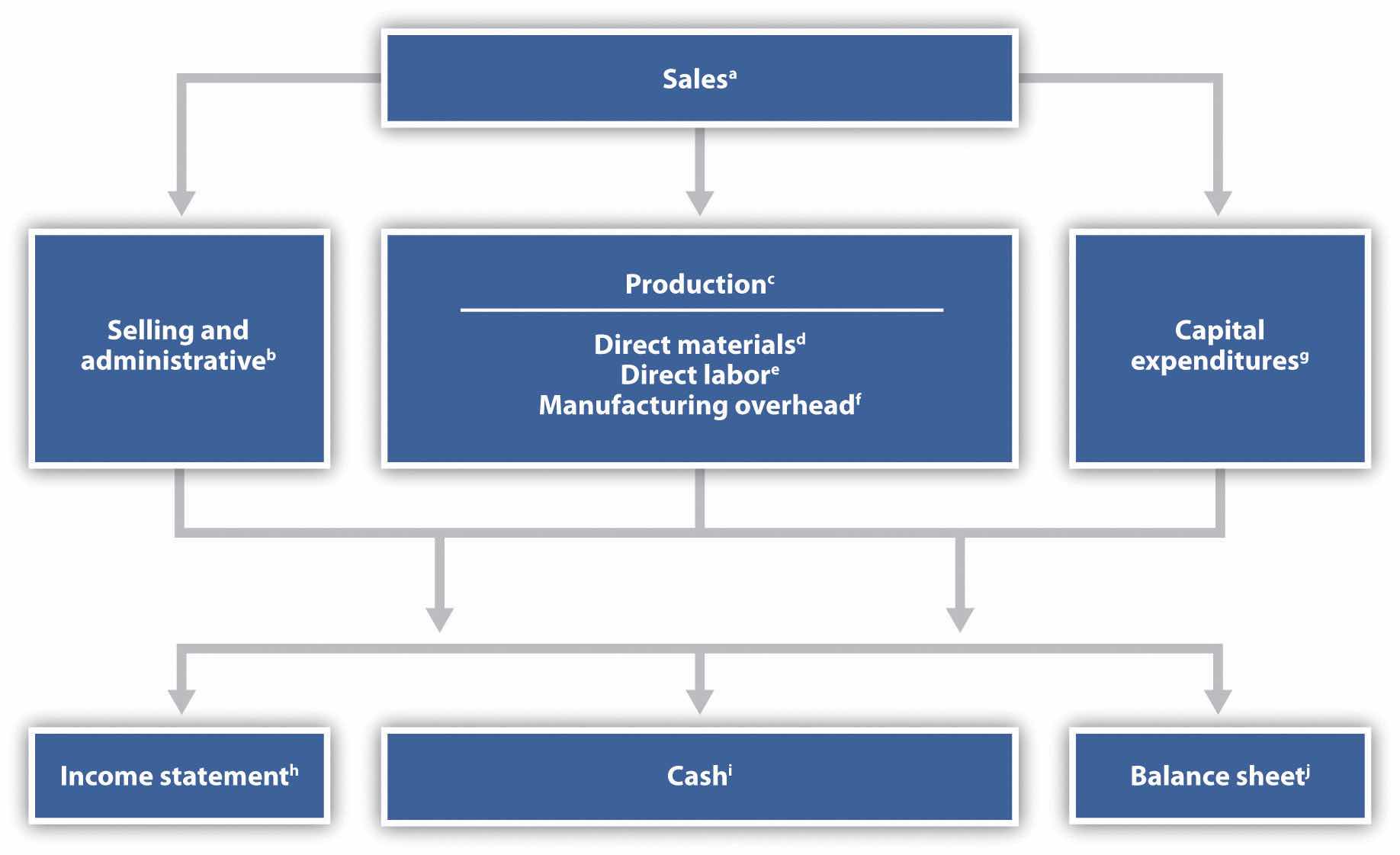

Most organizations have a budget committee that supervises the budgeting process. A budget committeeA group within the organization responsible for overseeing and approving the master budget. is a group within the organization responsible for overseeing and approving the master budget. A master budgetA series of budget schedules outlining the organization’s plans for the upcoming period. is a series of budget schedules outlining the organization’s plans for the upcoming period (typically for a year and presented in monthly or quarterly time periods). The master budget can take many different forms but often includes schedules that provide planning for sales, production, selling and administrative expenses, and capital expenditures. These schedules lead to the budgeted income statement, cash flows, and balance sheet (also part of the master budget).

Figure 9.1 "Master Budget Schedules" shows the components of the master budget with references to the figure in which we present each component for Jerry’s Ice Cream.

Figure 9.1 Master Budget Schedules

a See Figure 9.3 "Sales Budget for Jerry’s Ice Cream" for the sales budget.

b See Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream" for the selling and administrative budget.

c See Figure 9.4 "Production Budget for Jerry’s Ice Cream" for the production budget.

d See Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream" for the direct materials purchases budget.

e See Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream" for the direct labor budget.

f See Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream" for the manufacturing overhead budget.

g See Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream" for the capital expenditures budget.

h See Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream" for the budgeted income statement.

i See Figure 9.11 "Cash Budget for Jerry’s Ice Cream" for the cash budget.

j See Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream" for the budgeted balance sheet.

Solution to Review Problem 9.2