Question: From the previous discussion, we know that planning and control functions are often designed to evaluate the performance of employees and departments of an organization. This often includes employees overseeing financial information. Thus it is important to understand how most large companies organize their accounting and finance personnel. What are the accounting and finance positions within a typical large company, and what functions do they perform?

Answer: Let’s look at an example to answer this question. Suppose you are the president of Sportswear Company, mentioned earlier in the chapter, which produces hats and jerseys for fans of professional sports teams. Assume this is a large public company. (The term public companyA company whose shares of stock are publicly traded. refers to a company whose shares of stock are publicly traded—that is, the general investing public can purchase and sell ownership in the company.) As president of Sportswear, you ask the following questions:

The challenge is to determine who within Sportswear would be best suited to answer each of these questions. An organization chart will help in finding a solution.

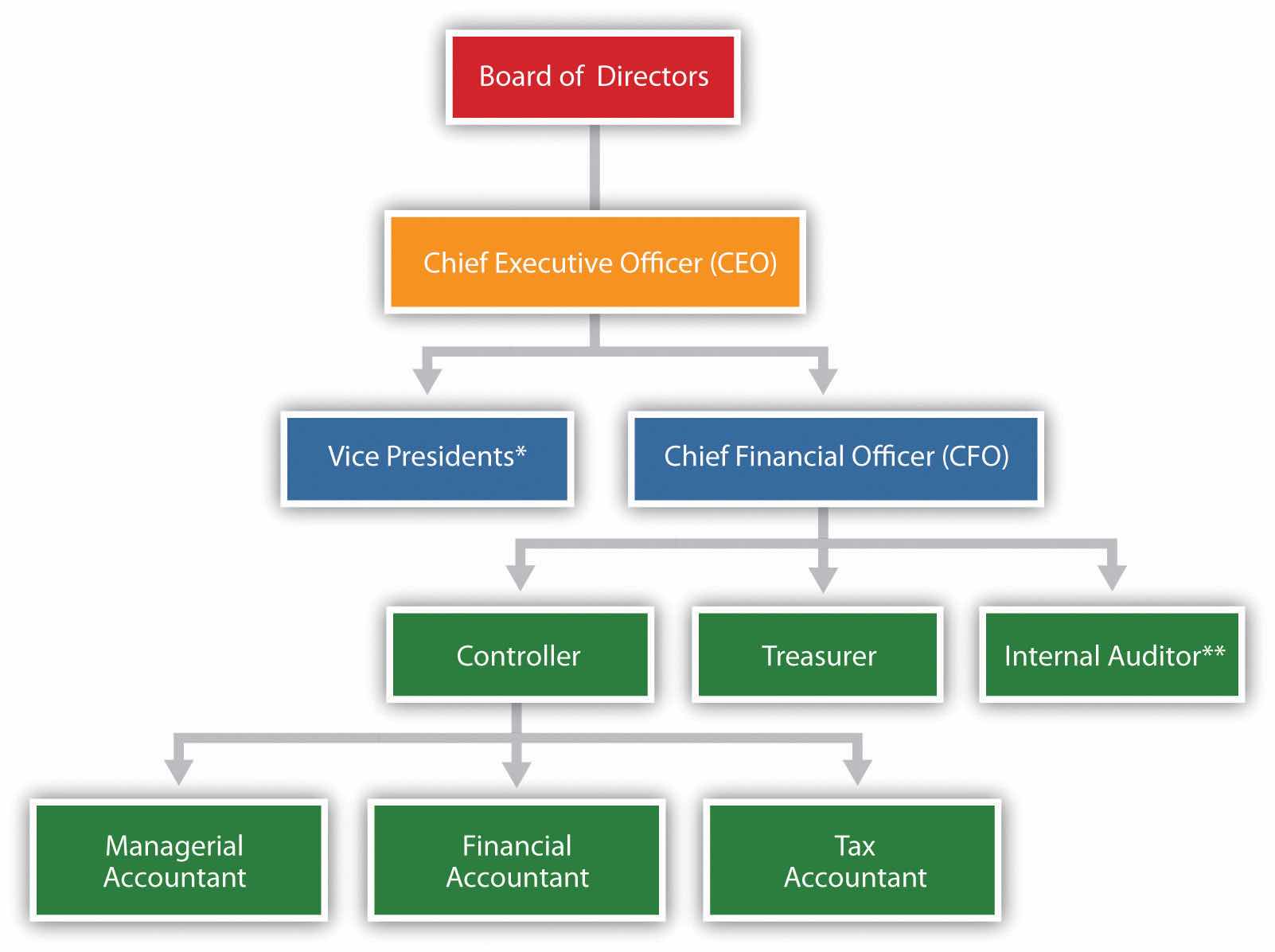

Figure 1.1 "A Typical Organization Chart" is a typical organization chart; it shows how accounting and finance personnel fit within most companies. The personnel at the bottom of the chart report to those above them. For example, the managerial accountant reports to the controller. At the top of the chart are those who control the company, typically the board of directors (who are elected by the owners or shareholders). Review Figure 1.1 "A Typical Organization Chart" before moving on to the detailed discussion of each important finance and accounting position.

Figure 1.1 A Typical Organization Chart

*Represents vice presidents of various departments outside of accounting and finance such as production, personnel, and research and development.

**In addition to reporting to the chief financial officer, the internal auditor typically reports independently to the board of directors and/or the audit committee (made up of select members of the board of directors).

The chief financial officer (CFO)The person in charge of all finance and accounting functions within the organization. is in charge of all the organization’s finance and accounting functions and typically reports to the chief executive officer.

The controllerThe person responsible for managing the accounting staff that provides managerial accounting information used for internal decision making, financial accounting information for external reporting purposes, and tax accounting information to meet tax filing requirements. is responsible for managing the accounting staff that provides managerial accounting information used for internal decision making, financial accounting information for external reporting purposes, and tax accounting information to meet tax filing requirements. The three accountants the controller manages are as follows:

The treasurerThe person responsible for obtaining financing, projecting cash flow needs, and managing cash and short-term investments for the organization. reports directly to the CFO. A treasurer’s primary duties include obtaining sources of financing for the organization (e.g., from banks and shareholders), projecting cash flow needs, and managing cash and short-term investments.

An internal auditorThe person responsible for confirming that controls within the company are effective in ensuring accurate financial data. reports to the CFO and is responsible for confirming that the company has controls that ensure accurate financial data. The internal auditor often verifies the financial information provided by the managerial, financial, and tax accountants (all of whom report to the controller and ultimately to the CFO). If conflicts arise with the CFO, an internal auditor can report directly to the board of directors or to the audit committee, which consists of select board members.

Question: The organization chart in Figure 1.1 "A Typical Organization Chart" is intended to serve as a guide. However, all organizations are not the same, particularly smaller organizations. How might the organizational structure differ for a small organization?

Answer: Smaller organizations tend to have only one or two key finance and accounting personnel who perform the functions described previously. For example, one accountant might perform the financial and managerial accounting duties while another takes care of the tax work (or the tax work might be contracted out to a tax firm). Instead of employing its own internal auditor, an organization might hire one from an outside consulting firm. Some organizations may not have a CFO, or they may have a CFO but not a controller. An organization’s structure depends on many different factors, including its size and reporting requirements, as indicated in the Note 1.23 "Business in Action 1.2".

The Organizational Structure of a Not-for-Profit Symphony

Financial limitations prevent a small not-for-profit symphony in California from hiring full-time finance and accounting employees. In spite of having annual revenues approaching $200,000, all financial transactions are processed and recorded by a part-time bookkeeper hired by the symphony. The bookkeeper also inputs budget information and provides monthly financial reports to the treasurer. The treasurer, a volunteer member of the board of directors, is responsible for establishing the annual budget and providing monthly financial reports to the board of directors. An outside firm prepares and processes all tax filings, assembles annual financial statements, and performs a review of the accounting operations at the end of each fiscal year.

Notice how the symphony does not have any of the formal positions identified in Figure 1.1 "A Typical Organization Chart", with the exception of the treasurer. This illustrates how financial constraints and reporting requirements may require an organization to be creative in establishing its organizational structure.

For each of the six questions listed at the beginning of this section for Sportswear Company, determine who within the company would be responsible for providing the appropriate information. Assume Sportswear has the same organizational structure as the one shown in Figure 1.1 "A Typical Organization Chart".

Solution to Review Problem 1.3