This is “Predictions and Effects”, section 5.4 from the book Finance, Banking, and Money (v. 1.0).

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. You may also download a PDF copy of this book (8 MB) or just this chapter (709 KB), suitable for printing or most e-readers, or a .zip file containing this book's HTML files (for use in a web browser offline).

5.4 Predictions and Effects

Learning Objective

- How does the interest rate react to changes in the money supply?

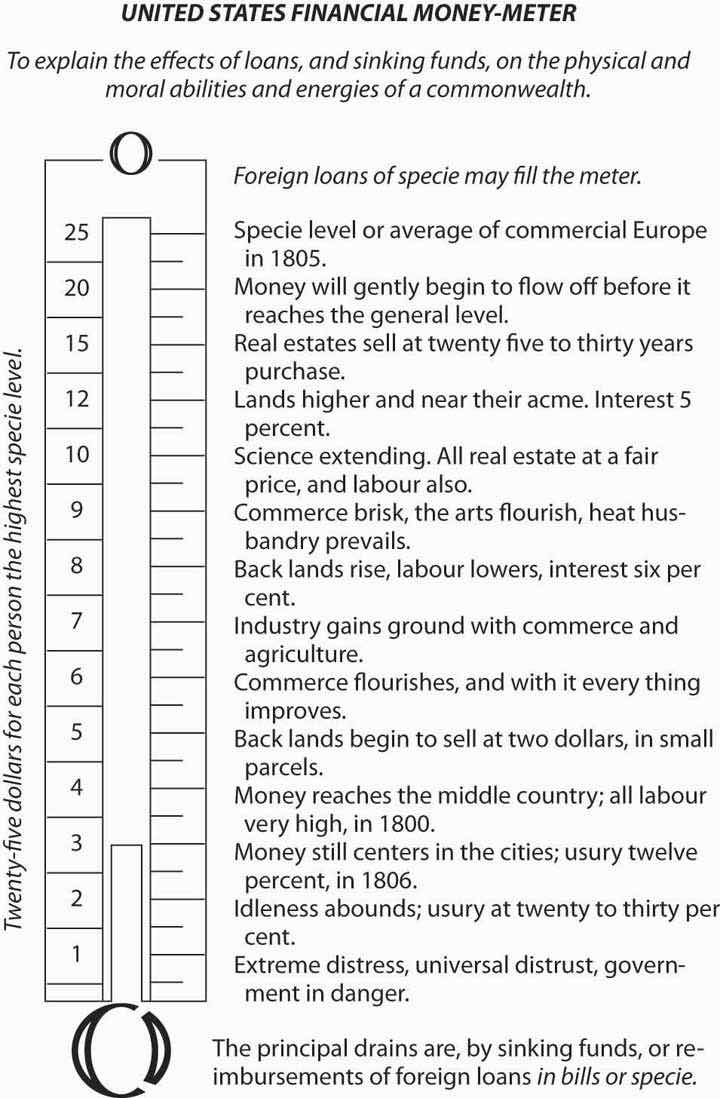

We’re almost there! As noted above, the liquidity preference framework predicts that increasing the money supply will decrease the interest rate. This liquidity effect, as it is called, holds if all other factors, including income, actual inflation, and expected inflation, remain the same. In the distant past, the ceteris paribus condition indeed held, as suggested in Figure 5.10 "United States financial money meter, ca. 1800". The excerpt in the figure is taken from an early nineteenth-century economic treatise.

Figure 5.10 United States financial money meter, ca. 1800

The key point is that, as the money supply (here presented in per capita terms, from $1 to $25 per person) increases, the interest rate falls, as the model predicts. At $2 per person “usury,” an antiquated term for “interest,” is at “twenty to thirty percent.” At $3, it falls to 12 percent, as in 1806. At $8 per head, it sinks to 6 percent, while at $12, it goes to 5, and at $15, to 3.33 or 4. (“Real estates sell at twenty five to thirty years purchase” is an old-fashioned way of stating this. Think about it in terms of the perpetuity equation you learned in Chapter 4 "Interest Rates": i = FV/PV, where FV is 1 and PV 25 or 30 times that, 25 or 30 times the annual income generated by the asset. i = 1/25 = .04 and i = 1/30 = .033333.) Most of the world was on a commodity standard (gold and/or silver) then, so the money supply was self-equilibrating, expanding and contracting automatically, as explained in Chapter 3 "Money". At $20 or so per person, money began to “flow off,” i.e., to be exported, and would never exceed $25. So monetary expansion did not cause prices to rise permanently; the expectation was one of zero net inflation in the medium to long term.

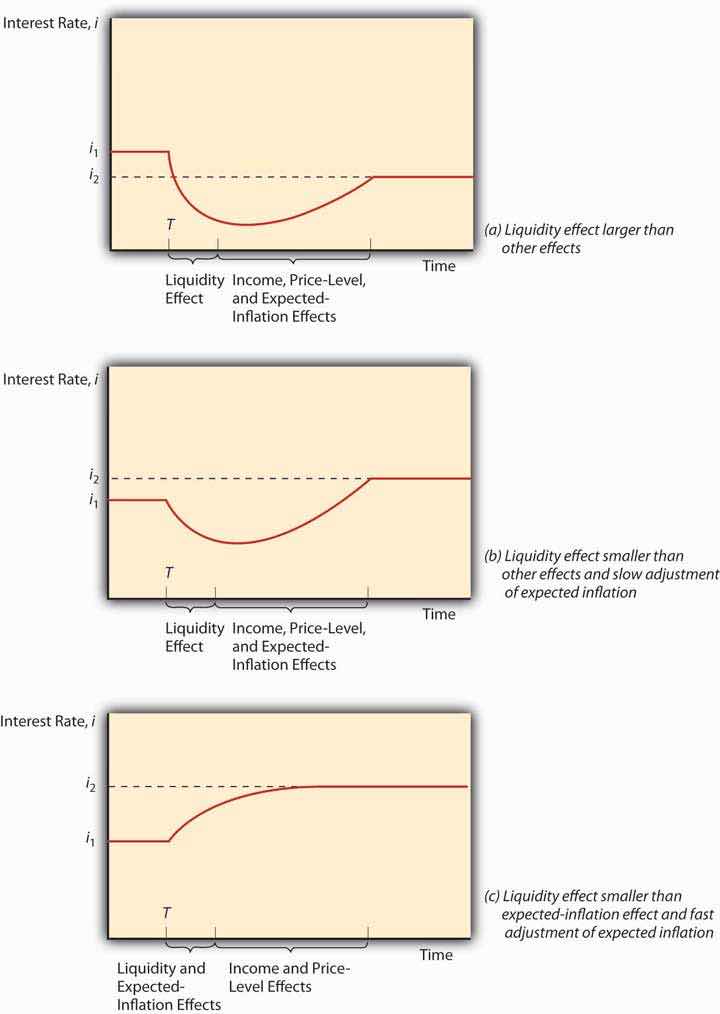

Today, matters are rather different. Government entities regulate the money supply and have a habit of expanding it because doing so prudently increases economic growth, employment, incomes, and other good stuff. Unfortunately, expanding the money supply also causes prices to rise almost every year, with no reversion to earlier levels. When the money supply increases today, therefore, inflation often actually occurs and people begin to expect inflation in its wake. Each of these three effects, called the income, price level, and expected inflation effects, causes the interest rate to rise for the reasons discussed above. When the money supply increases, the liquidity effect, which lowers the interest rate, battles these three countervailing effects. Sometimes, as in the distant past, the liquidity effect wins out. When the money supply increases (or increases faster than usual), the liquidity effect wins out, and the interest rate declines and stays below the previous level. Sometimes, often in modern industrial economies with independent central banksA monetary authority that is controlled by public-interested technocrats rather than by self-interested politicians. For more information, see Chapter 13 "Central Bank Form and Function"., the liquidity effect wins at first and the interest rate declines, but then incomes rise, inflation expectations increase, and the price level actually rises, eventually causing the interest rate to increase above the original level. Finally, sometimes, as in modern undeveloped countries with weak central banking institutions, the expectation of inflation is so strong and so quick that it overwhelms the liquidity effect, driving up the interest rate immediately. Later, after incomes and the price level increase, the interest rate soars yet higher. Figure 5.11 "Money supply growth and nominal interest rates" summarizes this discussion graphically.

Figure 5.11 Money supply growth and nominal interest rates

Stop and Think Box

Famed monetary economist and Nobel laureate Milton Friedmanhttp://www.econlib.org/library/Enc/bios/Friedman.html was a staunch supporter of free markets and a critic of changes in the price level, particularly the rampant inflation of the 1970s. He argued that government monetary authorities ought to increase the money supply at some known, constant rate. If Friedman was so worried about price level changes, why didn’t he advocate permanently fixing the money supply (MS)?

By fixing the MS, the interest rate would have risen higher and higher as the demand for money increased due to higher incomes and even simple population growth. Only deflation (decreases in the price level) could have countered that tendency, but deflation, Friedman knew, was as pernicious as inflation. A constant rate of MS growth, he believed, would keep the price level relatively stable and interest rate fluctuations less frequent or severe.

The ability to forecast changes in the interest rate is a rare but profitable gift. Professional interest rate forecasters are rarely right on the mark and often are far astray,www.finpipe.com/intratgo.htm and half the time they don’t even get the direction (up or down) right.taylorandfrancis.metapress.com/(vqspd445seikpajibz05ch45)/app/home/contribution.asp?referrer =parent&backto=issue,5,9;journal,15,86;linkingpublicationresults,1:100411,1 That’s what we’d expect if their forecasts were determined by flipping a coin! We’ll discuss why this might be in Chapter 7 "Rational Expectations, Efficient Markets, and the Valuation of Corporate Equities". Therefore, we don’t expect you to be able to predict changes in the interest rate, but we do expect you to be able to post-dict them. In other words, you should be able to narrate, in words and appropriate graphs, why past changes occurred. You should also be able to make predictions by invoking the ceteris paribus assumption.

Key Takeaways

- Under a commodity money system such as the gold standard, an increase in the money supply decreases the interest rate and a decrease in the money supply increases it.

- Under a floating or fiat money system like we have today, an increase in the money supply might induce interest rates to rise immediately if inflation expectations were strong or to rise with a lag as actual inflation took place.