Wealth in the United States is commonly measured in terms of net worth, which is the sum of all assets, including home equity, minus all liabilities. The wealth—more specifically, the median net worth—of households in the United States varies with relation to race, education, geographic location, and gender. While income is often seen as a type of wealth in colloquial language use, wealth and income are two substantially different measures of economic prosperity. While there may be a high correlation between income and wealth, the relationship cannot be described as causal.

Assets are known as the raw materials of wealth, and they consist primarily of stocks and other financial and non-financial property, particularly home ownership, that allows individuals to increase their wealth. Home ownership is one of the main sources of wealth among families in the United States. However, there are racial differences in the acquisition of housing, and this inequality reproduces stratification in wealth across race. For white families, home ownership is worth, on average, $60,000 more than it is worth for black families. A lower proportion of people of color than white people have access to the financial resources needed to purchase a home with the intention of letting its value appreciate over time to increase personal wealth. In many communities with large minority populations, high interest rates can cause roadblocks to home ownership.

Data on personal wealth in the United States shows that the inequality between the nation's richest and poorest citizens is vast. For example, just 400 Americans have the same wealth as half of all Americans combined. In 2007 more than 37 million U.S. citizens, or 12.5% of the population, were classified as poor by the Census Bureau. In 2007 the richest 1% of the American population owned 34.6% of the country's total wealth, and the next 19% owned 50.5%. Thus, the top 20% of Americans owned 85% of the country's wealth and the bottom 80% of the population owned 15%.

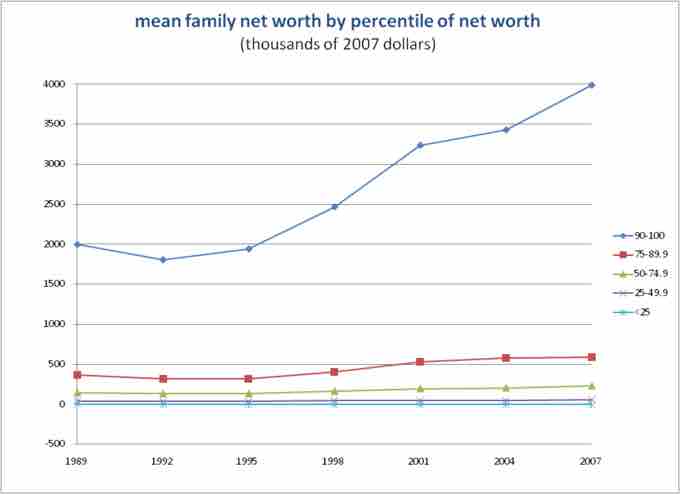

Mean Family Net Worth by Decile

This graph shows changes in the average net worth of families in each decile of the U.S. income hierarchy. In recent years, the average net worth of high-income families has grown significantly more than that of middle and lower-income families.