Introduction

Privatization can have several meanings. Primarily, it is the process of transferring ownership of a business, enterprise, agency, public service, or public property from the public sector (a government) to the private sector, either to a business that operates for a profit or to a non-profit organization. The term can also mean government outsourcing of services or functions to private firms, e.g. revenue collection, law enforcement, and prison management. Privatization has also been used to describe two unrelated transactions. The first is the buying of all outstanding shares of a publicly traded company by a single entity, making the company private. This is often described as private equity. The second is a demutualization of a mutual organization or cooperative to form a joint stock company.

Outsourcing is the contracting out of a business process, which an organization may have previously performed internally or has a new need for, to an independent organization from which the process is purchased back as a service. Though the practice of purchasing a business function—instead of providing it internally—is a common feature of any modern economy, the term outsourcing became popular in America near the turn of the 21st century. An outsourcing deal may also involve transfer of the employees and assets involved to the outsourcing business partner. The definition of outsourcing includes both foreign or domestic contracting, which may include offshoring, described as "a company taking a function out of their business and relocating it to another country."

Some privatization transactions can be interpreted as a form of a secured loan and are criticized as a "particularly noxious form of governmental debt. " In this interpretation, the upfront payment from the privatization sale corresponds to the principal amount of the loan, while the proceeds from the underlying asset correspond to secured interest payments – the transaction can be considered substantively the same as a secured loan, though it is structured as a sale. This interpretation is particularly argued to apply to recent municipal transactions in the United States, particularly for fixed term, such as the 2008 sale of the proceeds from Chicago parking meters for 75 years. It is argued that this is motivated by "politicians' desires to borrow money surreptitiously," due to legal restrictions on and political resistance to alternative sources of revenue, namely raising taxes or issuing debt.

Outsourcing in the United States

"Outsourcing" became a popular political issue in the United States, having been confounded with offshoring, during the 2004 U.S. presidential election. The political debate centered on outsourcing's consequences for the domestic U.S. workforce. Democratic U.S. presidential candidate John Kerry criticized U.S. firms that outsource jobs abroad or that incorporate overseas in tax havens to avoid paying their "fair share" of U.S. taxes during his 2004 campaign, calling such firms "Benedict Arnold corporations. "

Criticism of outsourcing, from the perspective of U.S. citizens, generally revolves around the costs associated with transferring control of the labor process to an external entity in another country. A Zogby International poll conducted in August 2004 found that 71% of American voters believed that "outsourcing jobs overseas" hurt the economy while another 62% believed that the U.S. government should impose some legislative action against companies that transfer domestic jobs overseas, possibly in the form of increased taxes on companies that outsource.

Union busting is one possible cause of outsourcing . As unions are disadvantaged by union busting legislation, workers lose bargaining power and it becomes easier for corporations to fire them and ship their job overseas. Another given rationale is the high corporate income tax rate in the U.S. relative to other OECD nations, and the uncommonness of taxing revenues earned outside of U.S. jurisdiction. However, outsourcing is not solely a U.S. phenomenon as corporations in various nations with low tax rates outsource as well, which means that high taxation can only partially, if at all, explain US outsourcing. For example, the amount of corporate outsourcing in 1950 would be considerably lower than today, yet the tax rate was actually higher in 1950.

Union Busting

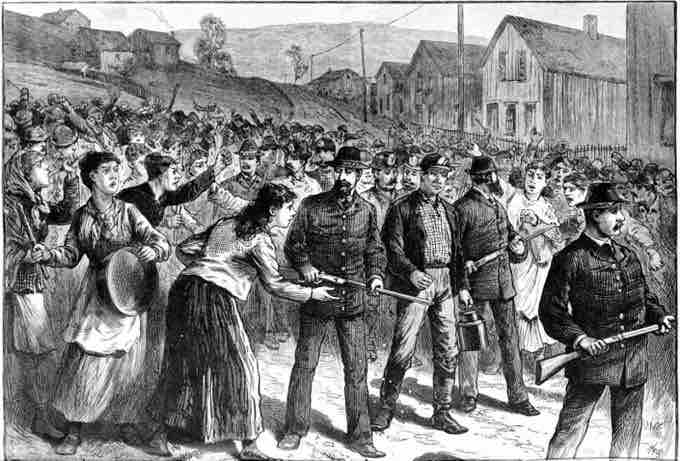

Pinkerton guards escort strikebreakers in Buchtel, Ohio, 1884.

It is argued that lowering the corporate income tax and ending the double-taxation of foreign-derived revenue (taxed once in the nation where the revenue was raised, and once from the U.S.) will alleviate corporate outsourcing and make the U.S. more attractive to foreign companies. However, while the US has a high official tax rate, the actual taxes paid by US corporations may be considerably lower due to the use of tax loopholes, tax havens, and "gaming the system. " Rather than avoiding taxes, outsourcing may be mostly driven by the desire to lower labor costs (see standpoint of labor above). Sarbanes-Oxley has also been cited as a factor for corporate flight from U.S. jurisdiction.