Market Share

Market share is the percentage of a market (defined in terms of either units or revenue) accounted for by a specific entity. Increasing market share is one of the most important objectives of business. The main advantage of using market share as a measure of business performance is that it is less dependent upon macro-environmental variables, such as the state of the economy or changes in tax policy. In a survey of nearly 200 senior marketing managers, 67% responded that they found the "dollar market share" metric very useful, while 61% found "unit market share" very useful (both methods are discussed below).

Purpose

Market share is a key indicator of market competitiveness—that is, how well a firm is doing against its competitors. It enables managers to judge not only total market growth or decline but also trends in customers' selections among competitors. Research has also shown that market share is a desired asset among competing firms. Experts, however, discourage making market share an objective and criterion upon which to base economic policies. The aforementioned usage of market share as a basis for gauging the performance of competing firms has fostered a system in which firms make decisions with regard to their operation with careful consideration of the impact of each decision on the market share of their competitors.

Construction

-- Unit market share: The units sold by a particular company as a percentage of total market sales, measured in the same units.

Unit market share (%) = 100 * Unit sales(#) / Total Market Unit Sales(#)

Unit sales (#) = Unit market share (%) * Total Market Unit Sales (#) / 100

Total Market Unit Sales (#) = 100 * Unit sales (#) / Unit market share (%)

-- Revenue market share: Revenue market share differs from unit market share in that it reflects the prices at which goods are sold. In fact, a relatively simple way to calculate relative price is to divide revenue market share by unit market share.

Revenue market share (%) = 100 * Sales Revenue ($) / Total Market Sales Revenue ($)

Methodologies

There is no generally acknowledged best method for calculating market share. This is unfortunate, as different methods may yield not only different computations of market share at a given moment, but also widely divergent trends over time. The reasons for these disparities include variations in the lenses through which share is viewed (units versus dollars), where in the channel, measurements are taken (shipments from manufacturers versus consumer purchases), market definition (scope of the competitive universe), and measurement error. Nonetheless, both methods have useful implications for managers.

Market Dominance

Market dominance is a measure of the strength of a brand, product, service, or firm, relative to competitive offerings. In defining market dominance, you must see to what extent a product, brand, or firm controls a product category in a given geographic area.

Methodology

There are several ways of calculating market dominance. The most direct is market share, discussed above. However, market share is not a perfect proxy of market dominance. The influences of customers, suppliers, competitors in related industries, and government regulations must be taken into account. Although there is no set relationship between dominance and market share, the following are general criteria: A company, brand, product, or service that has a combined market share exceeding 60% most probably has market power and market dominance. A market share of over 35% but less than 60% is an indicator of market strength but not necessarily dominance. A market share of less than 35% is not an indicator of strength or dominance and will not raise anti-competitive concerns by government regulators.

The concentration ratio of an industry is used as an indicator of the relative size of leading firms in relation to the industry as a whole. One commonly used concentration ratio is the four-firm concentration ratio, which consists of the combined market share of the four largest firms, as a percentage, in the total industry. The higher the concentration ratio, the greater the market power of the leading firms.

The Herfindahl index is a measure of the size of firms in relation to the industry and an indicator of the amount of competition among them. It is defined as the sum of the squares of the market shares of each individual firm. It ranges from 0 to 10,000, moving from a very large amount of very small firms to a single monopolistic producer. Decreases in the Herfindahl index indicate a loss of pricing power and an increase in competition, and vice versa.

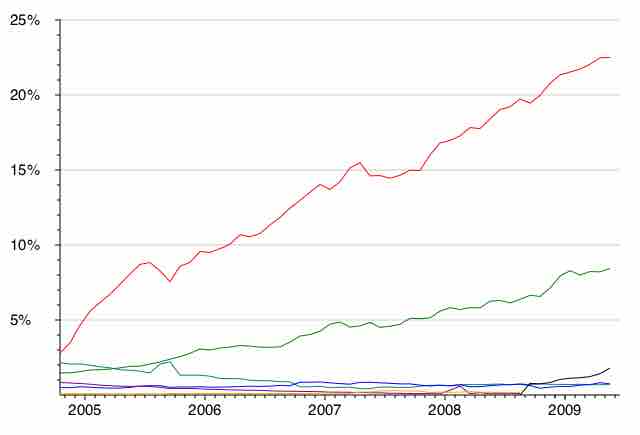

Some examples of market dominant products are: Photoshop, iPod, Facebook, Microsoft Office, Intel and Google. Market share data can usually be shown in pie charts, bar graphs, or line graph such as this one .

Browser Market Share

A line graph is one way to look at market share over time.