Incentive programs, also known as "pay for performance," provide employees, consumers, or providers with financial rewards as a way of motivating better performance. Various behavioral factors might be considered prior to establishing an incentive program, including the target audience's motivation, skills, recognition, understanding of the goals, and ability to measure progress. The interest of participants plays a vital role in determining an incentive program, as the goal is to motivate their behavior.

Pay-for-Performance Jobs

Pay-for-performance programs are quite common in a number of industries, most notably sales. A sales role often features a contractual agreement that stipulates a certain percentage of a given representative's sales contribute to that sales rep's own salary. This motivates sales professionals to pursue higher success rates, as their own income will directly correlate with their efficacy.

Other types of pay-for-performance jobs are found in the manufacturing, restaurant, and financial industries. The basic premise is simple: the more sales or profits generated by the individual, the larger the share of the organization's profit that individual will receive in return.

Incentive Programs

Managerial roles can function similarly to these pay-for-performance jobs, where the success of the company (or department) will directly affect the salary of the manager. Managers are often motivated by financial rewards. Like other pay-for-performance programs, the incentive programs for managers are designed to increase their performance as well as the overall performance of the company. These and other incentive programs are often used to reduce turnover, boost morale and loyalty, improve employee wellness, increase retention, and drive performance.

The financial rewards of upper management are often the highest in the organization. Such financial incentive programs are based on the understanding that the top managers within a business are the most responsible for strategic planning and decision making. In this view, financial rewards like bonuses serve as an incentive for senior management to improve performance.

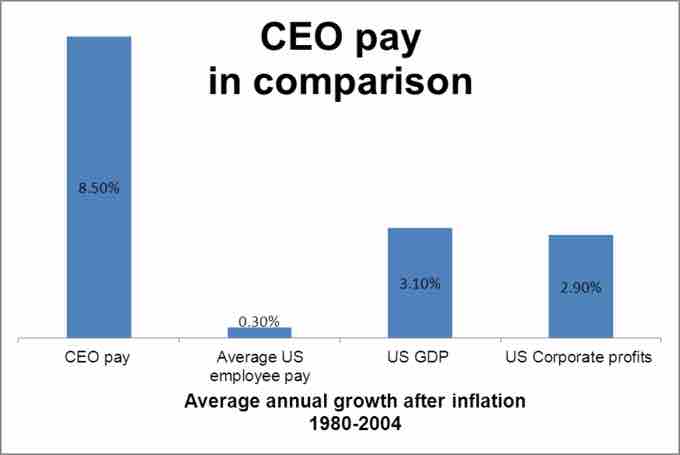

CEO pay growth compared to employee salaries, U.S. gross domestic product, and overall U.S. corporate profits

CEOs, as primary examples of upper managerial salary, receive high salaries in comparison to other gross income indicators. This contrast may be a result of the differing pay structure often associated with upper management.

A risk of incentive schemes is ethical hazards. Offering incentives to hit specific targets means the targets themselves can become the primary goal, rather than the improvement of the company's performance as a whole. This mindset may cause a reduction in overall performance—even as the rate of hitting targets climbs. In the wake of the global recession of 2008–2010, financial incentive schemes received greater criticism and oversight, partly for this very reason.