Managing Cash Collections

The cash receipts cycle requires a diligent collection process. A company must balance this need for quick cash collections with the needs and desires of its customers. For example, customers who are important to a firm's business should be treated carefully as opposed to customers who mean little or nothing to its future. Therefore, collection efforts must be customer specific in order to be effective. Specific collection techniques include letters, telephone calls, faxes, emails, and legal action. An example of a collection letter follows:

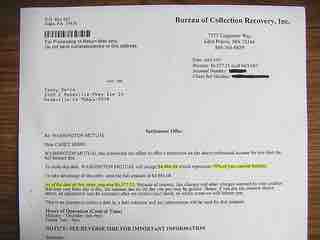

Our records indicate that a balance of $ 4,650.30 is over 90 days past due. We have sent monthly statements and reminders several times, but we have yet to receive payment or any explanation as to why payment should not be made. Please review this matter immediately. I will call you in the next five days to arrange payment.

The overall collection process should be pro-active and preventive. For example, wherever possible a company should try to collect payment immediately as products or services are delivered, i.e., receive payment in cash. This eliminates the need for invoicing and follow up collection techniques. A firm should always require deposits from customers that have a history of making late payments. It should use credit applications to weed out bad customers, and include a clause in the credit application that states all collection costs are reimbursed by the customer on delinquent accounts.

Example Collection Letter

A sample collection settlement letter.

Lock Box Banking

Lock box banking is a service offered to companies by commercial banks that simplifies collection and processing of account receivables. In general, a lockbox is a Post Office box that is accessible by a bank. A company may set up a lock box service with their bank for receiving customers' payments. The company's customers send their payments to the PO box, and the bank subsequently collects and processes these payments directly and deposits them to the company's account. Because the bank is making the collection, the funds that have been received are immediately deposited into the company's account without first being processed by the company's accounting system, thereby speeding up cash collection. Another benefit of the lockbox service is that a company can maintain special mailboxes in different locations around the country. A customer then sends payment to the closest lockbox.