Defining Accounts Receivable

Every business sells products or services to its customers. Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit. In most businesses, accounts receivable is executed by generating an invoice and either mailing or electronically delivering it to the customer. In turn, the customer must pay the invoice within an established timeframe, which is called the credit terms or payment terms. The accounts receivable departments use the sales ledger, which normally records:

- The sales a business has made

- The amount of money received for goods or services

- The amount of money owed at the end of each month (debtors)

Bookkeeping

On a company's balance sheet, accounts receivable is the money owed to that company by entities outside of the company. The receivables owed by the company's customers are called trade receivables. Account receivables are classified as current assets assuming that they are due within one year. These are the funds management is concerned with when considering working capital requirements.

Companies have two methods available to them for measuring the net value of accounts receivable, which is generally computed by subtracting the balance of an allowance account from the accounts receivable account. The first method is the allowance method, which establishes an allowance for doubtful accounts, or bad debt provision, that has the effect of reducing the balance for accounts receivable. The amount of the bad debt provision can be computed in two ways:

- By reviewing each individual debt and deciding whether it is doubtful (a specific provision)

- By providing for a fixed percentage (e.g. 2%) of total debtors (a general provision)

The second method is the direct write-off method. It is simpler than the allowance method in that it allows for one simple entry to reduce accounts receivable to its net realizable value. The entry would consist of debiting a bad debt expense account and crediting the respective accounts receivable in the sales ledger.

Revenue Recognition

A company has a choice of when to actually recognize revenue via various accounting methods. Revenue has a big impact on bottom-line profitability, so managers may be tempted to "manage" revenue recognition. Under accrual accounting, a firm can recognize revenue when it has:

- Delivered goods and the title is transferred to the buyer

- Performed all, or a substantial portion of, the services to be provided

- Incurred a substantial majority of the costs, and the remaining costs can be reasonably estimated

- Received either cash, a receivable, or some other asset for which a reasonably precise value can be assigned or collectibility is reasonably assured

Managers can sometimes tweak the period in which revenue is recognized to create a more attractive financial statement for a given circumstance .

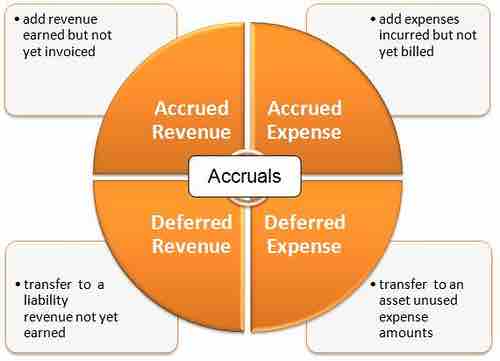

Accrual Recognition

This chart lays out methods for accruing revenue and expenses in accounting.