Collection Policy

Collecting upon accounts receivable is the final step in the credit extension process, and arguably the most difficult. In dealing with collections, it is important for a firm to start by monitoring its accounts receivable in order to determine whether its policy is working to the best advantage of the company. Accounts receivable days and an aging schedule are the most common monitor tools used.

Accounts Receivable Days

The accounts receivable days is the average number of days that it takes a firm to collect on its sales. By comparing this number to the number in the credit policy, a business can determine whether its policy is effective or not. The accounts receivable days is important because investors utilize this measure to evaluate a firm's credit management policy. This method does have its weaknesses. Seasonal sales patterns may cause accounts receivable days to change depending on when the calculation occurs. Therefore, management can potentially manipulate accounts receivable days to hide important information.

Aging Schedule

The other method commonly used is an aging schedule which categorizes accounts by the number of days they have been on the books. It can be constructed in one of two ways: using the number of accounts or using the dollar amount of the outstanding accounts receivable. If the percentages in the lower half of the schedule begin to increase, the firm needs to evaluate the effectiveness of its credit policy. Payment patterns provide information on the percentage of monthly sales that the firm collects each month after the sale. The payment pattern can be used to forecast the working capital needs for the business.

Receivable Turnover Ratio

Another way to evaluate a credit policy is to look at the receivable turnover ratio. This is a financial ratio that measures the number of times, on average, receivables are collected during a period.

Collecting Receivables

Collection Letter

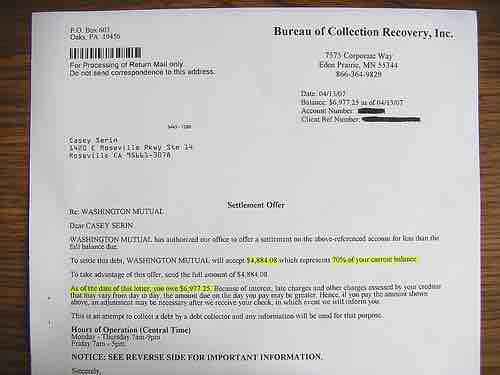

This is an example of a letter from a collection agency offering to settle a debt.

There are several methods companies can use to collect their outstanding receivables. Some do nothing, some send out reminders notifying customers of late payment, and some take legal action - sometimes at the first late payment. If firms so choose, they can utilize a collection agency. A collection agency is a business that pursues payments of debts owed by individuals or businesses. Most collection agencies operate as agents of creditors and collect debts for a fee or percentage of the total amount owed. There are many types of collection agencies. First-party agencies are oftentimes a subsidiary of the original company to whom the debt is owed. Third-party agencies are separate companies contracted by a business to collect debts on their behalf for a fee. A company may protect against bad-debts losses by purchasing trade credit insurance. This is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivables from loss due to credit risks like protracted default, insolvency, or bankruptcy.