Chapter 12

The Role of Risk in Capital Budgeting

By Boundless

The process of capital budgeting must take into account the different risks faced by corporations and their managers.

Risk aversion describes how people react to conditions of uncertainty and has implications for investment decisions.

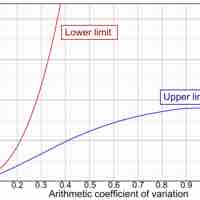

Some of the quantitative definitions of risk are grounded in statistical theory and lead naturally to statistical estimates, but some are more subjective.

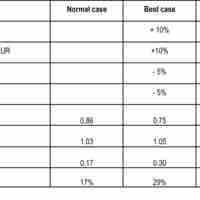

Sensitivity analysis determines how much a change in an input will affect the output.

Scenario analysis is a process of analyzing decisions by considering alternative possible outcomes.

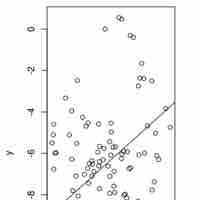

Monte Carlo simulation uses statistical data to figure out the average outcome of a scenario based on multiple, complex factors.

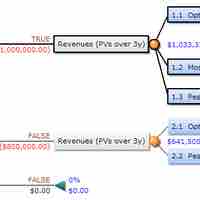

A decision tree is a decision support tool that uses a tree-like graph or model of decisions and their possible consequences.

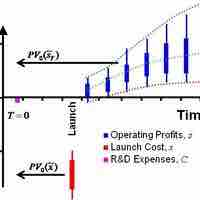

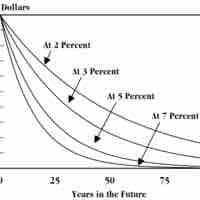

Discount rates are adjusted on an investment to investment basis, as different investments encounter different degrees of risk that must be considered when determining equitable returns.

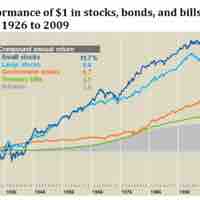

A longer time horizon usually requires a higher return, due to increased price volatility and uncertainty relating to possible outcomes.