Introduction

Financial management focuses on the practical significance of financial numbers. It asks: what do the figures mean? Sound financial management creates value and organizational agility through the allocation of scarce resources among competing business opportunities. It is an aid to the implementation and monitoring of business strategies and helps achieve business objectives. There are several goals of financial management, one of which is valuation .

Valuation

Valuation is, for some, one of the goals of financial management.

Valuation

In finance, valuation is the process of estimating what something is worth. Valuation often relies on fundamental analysis (of financial statements) of the project, business, or firm, using tools such as discounted cash flow or net present value. As such, an accurate valuation, especially of privately owned companies, largely depends on the reliability of the firm's historic financial information. Items that are usually valued are a financial asset or liability. Valuations can be done on assets (for example, investments in marketable securities such as stocks, options, business enterprises, or intangible assets such as patents and trademarks) or on liabilities (e.g., bonds issued by a company).

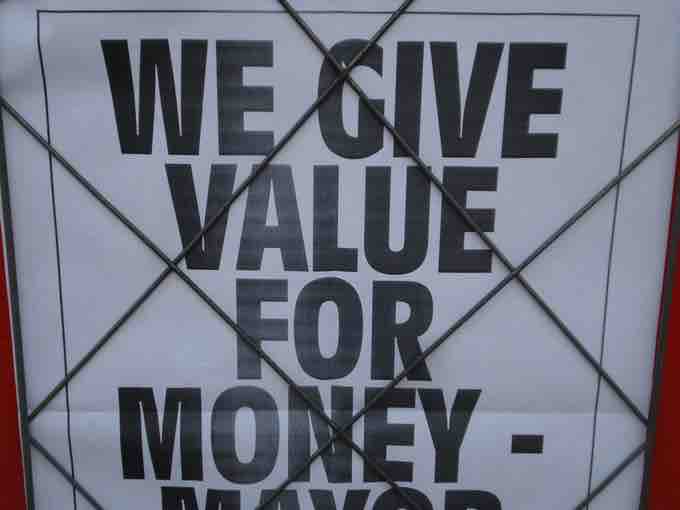

Valuation is used to determine the price financial market participants are willing to pay or receive to buy or sell a business. In addition to estimating the selling price of a business, the same valuation tools are often used by business appraisers to resolve disputes related to estate and gift taxation, divorce litigation, allocate business purchase price among business assets, establishing a formula for estimating the value of partners' ownership interest for buy-sell agreements, and many other business and legal purposes. Therefore, not only do managers want to keep reliable financial statements so that they can know the value of their own businesses, but they also want to manage finances well to enhance the value of their businesses to potential buyers, creditors, or investors.