Chapter 21

Financial Management Outside of the U.S.

By Boundless

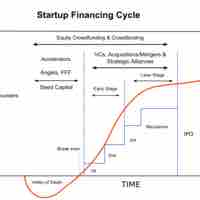

Global corporations operate in two or more countries and face many challenges in their quest to capture value in the global market.

Countertrade is a system of exchange in which goods and services are used as payment rather than money.

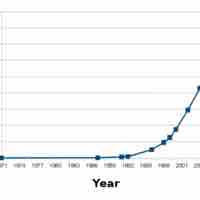

With the advent of improved communication and technology, corporations have been able to expand into multiple countries.

FDI is practiced by companies in order to benefit from cheaper labor costs, tax exemptions, and other privileges in that foreign country.

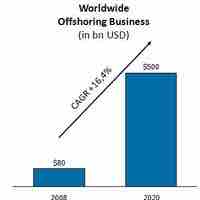

Offshoring entails a company moving a business process from one country to another.

Outsourcing business functions to developing foreign countries has become a popular way for companies to reduce cost.

When considering strategic entry into an international market, licensing is a low-risk and relatively fast foreign market entry tactic.

Imports are the inflow of goods and services into a country's market for consumption.

In a joint venture business model, two or more parties agree to invest time, equity, and effort for the development of a new shared project.

In contract manufacturing, a hiring firm makes an agreement with the contract manufacturer to produce and ship the hiring firm's goods.

Franchising enables organizations a low cost and localized strategy to expanding to international markets, while offering local entrepreneurs the opportunity to run an established business.

Exporting is the practice of shipping goods from the domestic country to a foreign country.

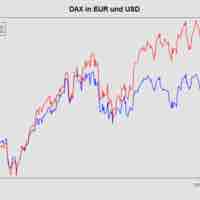

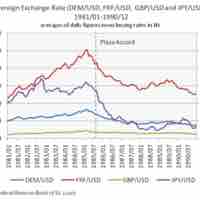

Foreign currency exposures are categorized as transaction/ short-run exposure, economic/ long-run exposure, and translation exposure.

Forwards, money market instruments, and futures are common instruments used to manage exchange risk.