Dividends are payments made by a corporation to its shareholder members on a regular (usually quarterly) basis–these are essentially the shareholder's portion of a company's profits. A dividend is allocated as a fixed amount per share. Therefore, a shareholder receives a dividend in proportion to their shareholding; owning more shares results in greater dividends for the shareholder. When it is time to make dividend payments, corporations always pay preferred stock owners first, and then common stock dividends are allocated after all preferred dividends are paid in full. In the United States, dividends are usually declared quarterly by the corporation's board of directors.

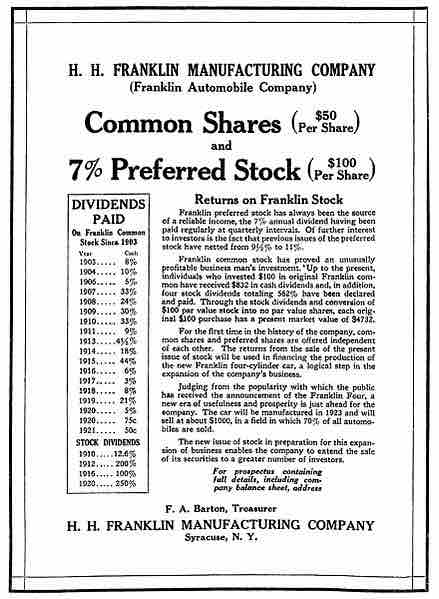

Historical dividend information for Franklin Automobile Company

Dividends are one of the privileges of stock ownership, and preferred shares get more rights to them than common shares do.

Dividends per share (DPS) refers to the dollar amount shareholders earn for each share, calculated by dividing total dividend amount by total number of shares outstanding. Dividend yield refers the ratio between dividends per share and the market price of each share, and it is expressed in terms of percentage. Payout ratio is calculated by dividing the company's dividend by the earnings per share. A payout ratio greater than 1 means the company is paying out more in dividends for the year than it earned, while a low payout ratio indicates that the company is retaining a greater proportion of their earnings instead of paying out dividends. These ratios have historically been used as indicators of a stock's investment strength and the company's overall performance.

Dividends may be allocated in different forms of payment, outlined below:Cash dividends are the most common. As the name suggests, these are paid out as currency via electronic funds transfer or a printed paper check. For each share owned, a declared amount of money is distributed. Thus, if a person owns 1000 shares and the cash dividend is USD 0.90 per share, the holder of the stock will be paid USD 900.Stock dividends (also known as scrips) are payments in the form of additional stock shares of the company itself or one of its subsidiaries, as the name suggests. This may be a more palatable option for companies who would prefer to use its earnings towards growth of the company, rather than diverting them into cash dividends for shareholders. Property dividends or dividends in specie (Latin for "in kind") are those paid out in the form of assets from the issuing corporation or another corporation, such as a subsidiary corporation. They are relatively rare and can take the form of securities of other companies owned by the issuer, or products and services. Companies may also offer reinvestment plans where shareholders can automatically reinvest dividends into more stock.

For public companies, there are six important dates to remember regarding dividends:

- Declaration date is the day the board of directors announces its intention to pay a dividend. On this day, a liability is created and the company records that liability on its books; it now owes the money to the stockholders. The board will also announce a date of record and a payment date.

- In-dividend date is the last day, which is one trading day before the ex-dividend date, where the stock is said to be cum dividend ('with [including] dividend'). In other words, existing holders of the stock and anyone who buys it on this day will receive the dividend, whereas any holders selling the stock lose their right to the dividend. After this date the stock becomes ex-dividend.

- Ex-dividend date (typically two trading days before the record date for U.S. securities) is the day on which all shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. This is an important date for any company that has many stockholders, including those that trade on exchanges, as it makes reconciliation of who is to be paid the dividend easier. Existing holders of the stock will receive the dividend even if they now sell the stock, whereas anyone who now buys the stock will not receive the dividend. It is relatively common for a stock's price to decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in the company's assets resulting from the declaration of the dividend. The company does not take any explicit action to adjust its stock price; in an efficient market, buyers and sellers will automatically price this in.

- Book closure date is when company will ideally temporarily close its books for fresh transfers of stock.

- Record date refers to the date that shareholders must be registered on record in order to receive the dividend. Shareholders who are not registered as of this date will not receive the dividend.

- Payment date is the day when the dividends will actually be distributed to the shareholders of a company or credited to brokerage accounts.