Section 4

Net Present Value

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

6 concepts

Defining NPV

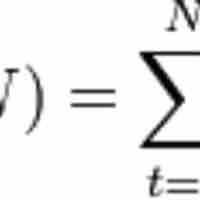

Net Present Value (NPV) is the sum of the present values of the cash inflows and outflows.

Calculating the NPV

The NPV is found by summing the present values of each individual cash flow.

Interpreting the NPV

A positive NPV means the investment makes sense financially, while the opposite is true for a negative NPV.

Advantages of the NPV method

NPV is easy to use, easily comparable, and customizable.

Disadvantages of the NPV method

NPV is hard to estimate accurately, does not fully account for opportunity cost, and does not give a complete picture of an investment's gain or loss.

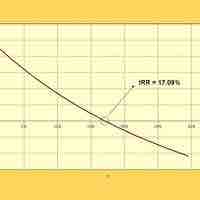

NPV Profiles

The NPV Profile graphs the relationship between NPV and discount rates.