The Yield to maturity (YTM) or redemption yield of a bond or other fixed-interest security, such as gilts, is the internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule .

Yield to Maturity

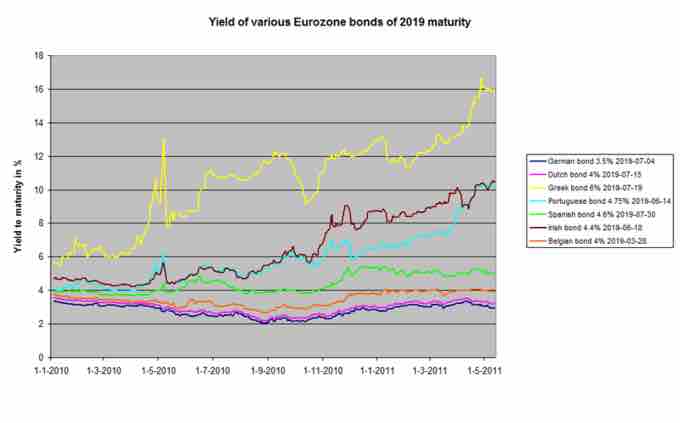

Development of yield to maturity of bonds of 2019 maturity of a number of Eurozone governments.

Contrary to popular belief, including concepts often cited in advanced financial literature, Yield to maturity does not depend upon a reinvestment of dividends. Yield to maturity, rather, is simply the discount rate at which the sum of all future cash flows from the bond (coupons and principal) is equal to the price of the bond. The formula for yield to maturity:

Yield to maturity (YTM) = [(Face value / Present value)1/Time period]-1

The YTM is often given in terms of Annual Percentage Rate (A.P.R.), but usually market convention is followed: in a number of major markets the convention is to quote yields semi-annually (for example, an annual effective yield of 10.25% would be quoted as 5.00%, because 1.05 x 1.05 = 1.1025).

If the yield to maturity for a bond is less than the bond's coupon rate, then the (clean) market value of the bond is greater than the par value (and vice versa).

- If a bond's coupon rate is less than its YTM, then the bond is selling at a discount.

- If a bond's coupon rate is more than its YTM, then the bond is selling at a premium.

- If a bond's coupon rate is equal to its YTM, then the bond is selling at par.

As some bonds have different characteristics, there are some variants of YTM:

- Yield to call: when a bond is callable (can be repurchased by the issuer before the maturity), the market looks also to the Yield to call, which is the same calculation of the YTM, but assumes that the bond will be called, so the cash flow is shortened.

- Yield to put: same as yield to call, but when the bond holder has the option to sell the bond back to the issuer at a fixed price on specified date.

- Yield to worst: when a bond is callable, puttable, exchangeable, or has other features, the yield to worst is the lowest yield of yield to maturity, yield to call, yield to put, and others.

For instance, you buy ABC Company bond which matures in 1 year and has a 5% interest rate (coupon) and has a par value of $100. You pay $90 for the bond. The current yield is 5.56% ((5/90)*100). If you hold the bond until maturity, ABC Company will pay you $5 as interest and $100 par value for the matured bond. Now for your $90 investment, you get $105, so your yield to maturity is 16.67% [= (105/90)-1] or [=(105-90)/90].