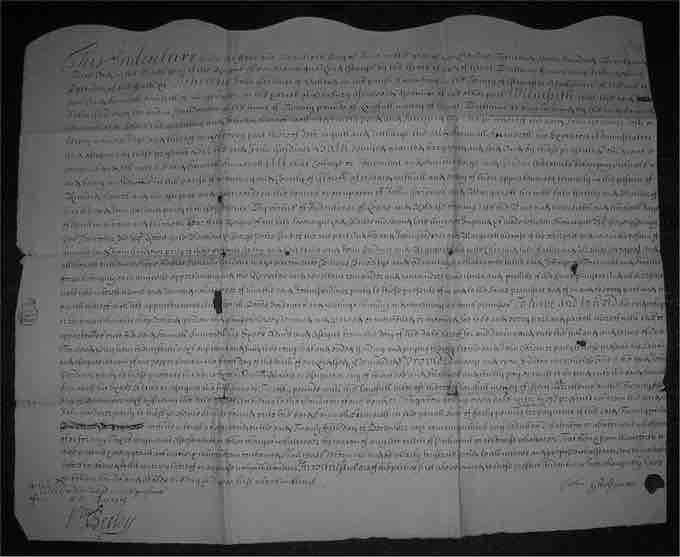

A bond indenture (also called a trust indenture or deed of trust) is a legal contract issued to lenders. The specifications given within the bond indenture define the responsibilities and commitments of the seller as well as those of the buyer by describing key terms such as the interest rate, maturity date, repayment dates, convertibility, pledge, promises, representations, covenants, and other terms of the bond offering. Failure to meet the payment requirements calls for drastic penalties, including liquidation of the issuer's assets .

Indenture

Bond indenture (also trust indenture or deed of trust) is a legal contract issued to lenders.

Because it would be impractical for the corporation to enter into a direct agreement with each of the many bondholders, the bond indenture is held by a trustee - usually a commercial bank or other financial institution - appointed by the issuing firm to represent the rights of the bondholders. The issuer of a bond will use the indenture to describe detail about the issuer and the bond trustee for interested investors to research the background of the bond issue. This is to ensure that the bondholder has a clear idea of when to expect interest payments, as well as whom to contact if he or she has questions or concerns. If the company fails to live up to the terms of the bond indenture, the trustee may bring legal action against the company on behalf of the bondholders.

When the offering memorandum is prepared in advance of marketing a bond, the indenture will typically be summarized in the "description of notes" section. This offering memorandum, also known as a prospectus, is a document that describes a financial security for potential buyers. A prospectus commonly provides investors with material information about mutual funds, stocks, bonds, and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties, and any other material information.

In the United States, public debt offerings in excess of $10 million require the use of an indenture of trust under the Trust Indenture Act of 1939. The rationale for this is that it is necessary to establish a collective action mechanism under which creditors can collect in a fair, orderly manner if default takes place (like that which occurs during bankruptcy).