Section 9

Bond Risk

By Boundless

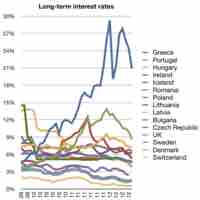

Price risk is the risk that the market price of a bond will fall, usually due to a rise in the market interest rate.

Reinvestment risk is the risk that a bond is repaid early, and an investor has to find a new place to invest with the risk of lower returns.

Price risk is positively correlated to changes in interest rates, while reinvestment risk is inversely correlated.

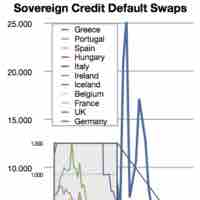

Default risk is the risk that a bond issuer will default on any type of debt by failing to make payments which it is obligated to make.

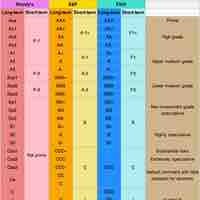

The credit rating is a financial indicator assigned by credit rating agencies; bond ratings below BBB-/Baa are considered junk bonds.

There is no guarantee of how much money will remain to repay bondholders in a bankruptcy, therefore, the value of the bond is uncertain.