Overview

Price risk and reinvestment risk both represent the uncertainty associated with the effects of changes in market interest rates. Both types of interest rate risks are important considerations in investments, corporate financial planning, and banking.

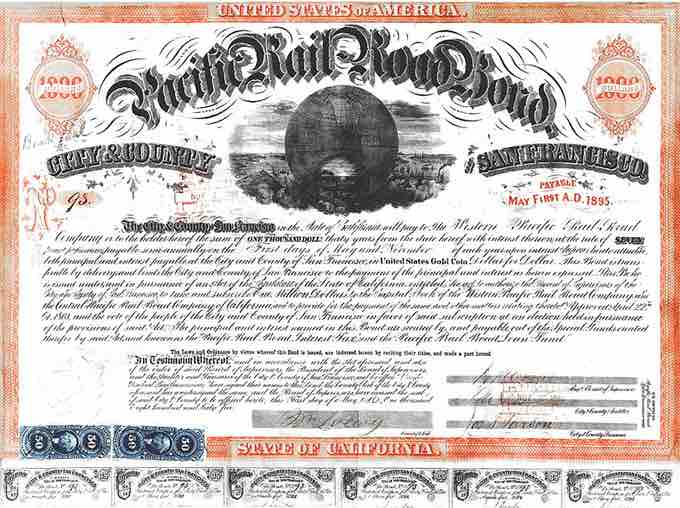

Pacific Railroad Bond

$1,000 (30 year, 7%) "Pacific Railroad Bond" (#93 of 200) issued by the City and County of San Francisco.

Price Risk

Price risk is the uncertainty associated with potential changes in the price of an asset caused by changes in interest rate levels in the economy. The price risk is sometimes referred to as maturity risk since the greater the maturity of an investment (the greater the duration), the greater the change in price for a given change in interest rates. Bond market prices will decrease in value when the generally prevailing interest rates rise (price risk is on the rise). Since the payments are fixed, a decrease in the market price of the bond means an increase in its yield. When the market interest rate rises, the market price of bonds will fall, reflecting investors' ability to get a higher interest rate on their money elsewhere — perhaps by purchasing a newly issued bond that already features the newly higher interest rate. When interest rates fall, bond prices increase, and there is less price risk. To sum up, price risk and interest rates are positively correlated.

Reinvestment Risk

Reinvestment risk is the risk that a particular investment might be canceled or stopped somehow, and that one may have to find a new place to invest their money with the risk that there might not be a similarly attractive investment available. This primarily occurs if bonds (which are portions of loans to entities) are paid back earlier than expected. When interest rates increase, there is less likelihood that a bond is called and paid back before maturity. So there is little reinvestment risk. When interest rates decrease, there is more likelihood that the bond is called and paid back earlier than expected. There is, accordingly, more reinvestment risk. Reinvestment risk and interest rates are inversely correlated.

Discussion

In summary, price risk and reinvestment risk are two main financial risks resulting from changes in interest rates. The former is positively correlated to interest rates, while reinvestment risk is inversely correlated to fluctuations in interest rates.