One of the advantages of ratio analysis is that it allows comparison across companies, an activity which is often called benchmarking. However, while ratios can be quite helpful in comparing companies within an industry and even across some similar industries, comparing ratios of companies across different industries may not be helpful and should be done with caution .

Industry

Comparing ratios of companies within an industry can allow an analyst to make like to like (apples to apples) comparisons. Comparisons across industries may be like to unlike (apples to oranges) comparisons, and thus less useful.

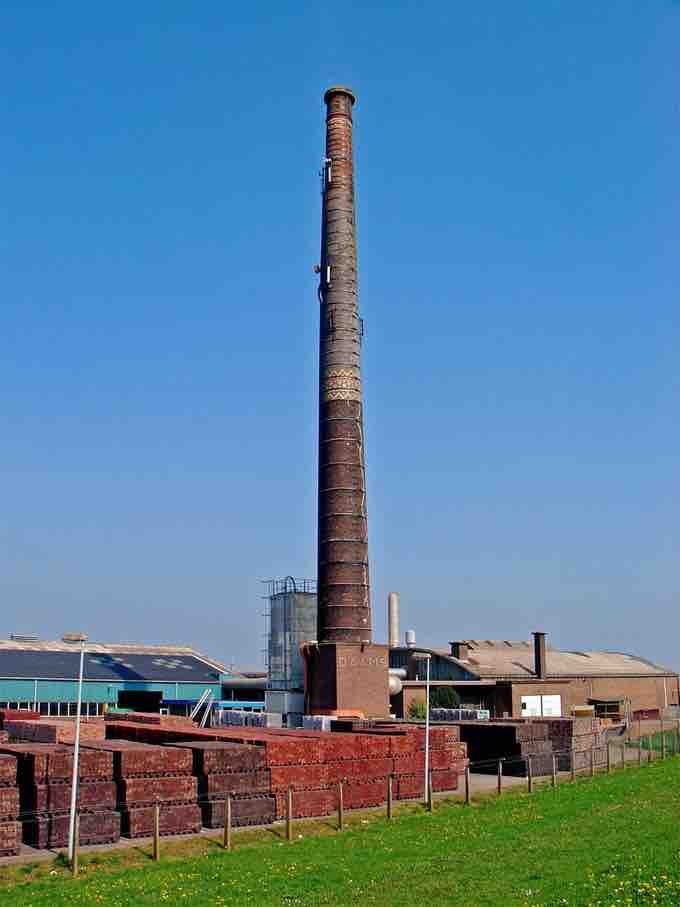

An industry represents a classification of companies by economic activity. At a very broad level, industry is sometimes classified into three sectors: primary or extractive, secondary or manufacturing, and tertiary or services. At a very detailed level are classification systems like the ISIC (International Standard Industrial Classification).

However, in terms of ratio analysis and comparing companies, it is most helpful to consider whether the companies being compared are comparable in the financial metrics being evaluated in the ratios. Different businesses will have different ratios for different reasons. A peer group is a set of companies or assets which are selected as being sufficiently comparable to the company or assets being valued (usually by virtue of being in the same industry or by having similar characteristics in terms of earnings growth and return on investment). From the investor perspective, peers can include companies that are not only direct product competitors but are subject to similar cycles, suppliers, and other external factors.

Valuation using multiples involves estimating the value of an asset by comparing it to the values assessed by the market for similar or comparable assets in the peer group. A valuation multiple is simply an expression of market value of an asset relative to a key statistic that is assumed to relate to that value. To be useful, that statistic – whether earnings, cash flow, or some other measure – must bear a logical relationship to the market value observed; to be seen, in fact, as the driver of that market value. The price to earnings ratio, for example, is a common multiple but can differ across companies that have different capital structures; this could make it difficult to compare this particular ratio across industries.

Additionally, there could be problems with the valuation of an entire industry, making ratio analysis of a company relative to an industry less useful. The use of multiples only reveals patterns in relative values, not absolute values such as those obtained from discounted cash flow valuations. If the peer group as a whole is incorrectly valued (such as may happen during a stock market "bubble"), then the resulting multiples will also be misvalued.