There are two main ways that a company can raise additional capital: through taking on debt, or selling equity. The best known way of selling equity is through an initial public offering (IPO) where a company sells shares on the market for the first time. However, once a company is public, it is still able to raise capital through what is called a seasoned equity offering.

A seasoned equity offering (SEO) is a broad term that refers to any sale of shares by the company after the initial IPO. In an SEO, a company already has shares outstanding that are trading on the market, and then decides to sell more securities.

Having an SEO has some effects on both the company and the shareholders. The current shareholders know that each share represents a certain proportion of ownership of the company. When more shares are put into the market, the percent of total ownership that share represents drops. The new shares dilute the value of the existing shares, and this is understandably, typically not looked upon kindly by those who own shares before the dilution. In theory, this dilution should correspond directly to a drop in the share price such that the market capitalization of the company remains the same. Since the market price of the existing shares should adjust when new shares are issued, an SEO theoretically does not increase the value of the firm .

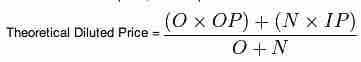

Dilution

In this equaltion O = original number of shares, OP = Current share price, N = number of new shares to be issued, and IP = issue price of new shares. The dilution of the shares outstanding should theoretically be met with a corresponding drop in share price.

It is important not to confuse a SEO with a secondary market offering. A SEO is the increase of the number of shares outstanding in the market in which the IPO took place, the primary market. A secondary market offering broadly means that shares are sold, but not by the company through the registration of new shares. For example, a block of shares previously offered to the public that is now held by large investors or institutions are sold. The sale of the shares does not benefit the company, and, more importantly, is not dilutive.