An investing activity is anything that has to do with changes in non-current assets -- including property and equipment, and investment of cash into shares of stock, foreign currency, or government bonds -- and return on investment -- including dividends from investment in other entities and gains from sale of non-current assets. These activities are represented in the investing income part of the income statement.

It is important to note that investing activity does not concern cash from outside investors, such as bondholders or shareholders. For example, a company may decide to pay out a dividend. A dividend is often thought of as a payment to those who invested in the company by buying its stock. However, this cash flow is not representative of an investing activity on the part of the company. The investing activity was undertaken by the shareholder; therefore, paying out a dividend is a financing activity.

When reporting investing activities, it is important to be able to decipher a cash inflow from a cash outflow. Examples of transactions involving cash inflows include:

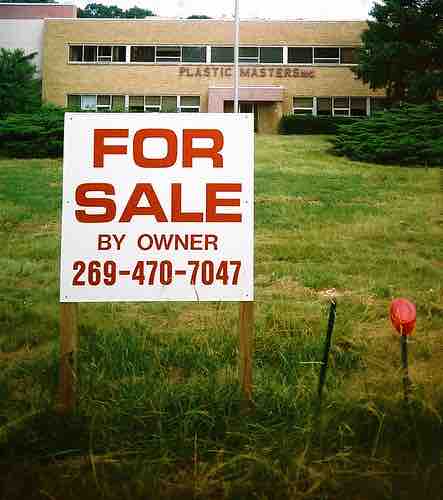

- the sale of property, plant, and equipment;

- the sale of available-for-sale and held-to-maturity securities; and

- the collection of long-term loans made to others.

In each of these cases, the Cash account would be debited -- due to the increase in cash -- and the account appropriate to the specific investment would be credited -- which could include Operating Assets, Equity Investments, or Debt Investments.

Examples of transactions involving cash outflows include:

- cash paid to purchase property, plant, and equipment;

- cash paid to purchase available-for-sale and held-to-maturity securities; and

- cash paid to make long-term loans to others.

In each of these cases, the account appropriate to the specific investment would be debited, and the Cash account would be credited, due to the decrease in cash.

Investment Activities

The sale of a factory would be an example of a cash inflow from investment.