A true duopoly is a specific type of oligopoly where only two producers exist in a market. There are two principle duopoly models: Cournot duopoly and Bertrand duopoly.

Cournot Duopoly

Cournot duopoly is an economic model that describes an industry structure in which firms compete on output levels. The model makes the following assumptions:

- There are two firms, which produce a homogeneous product;

- The number of firms is fixed;

- Firms do not cooperate (there is no collusion);

- Firms have market power, and each firm's output decision affects the good's price;

- Firms are economically rational and act strategically, seeking to maximize profit given their competitor's decisions; and

- Firms compete on quantity, and choose quantity simultaneously.

The Cournot model focuses on the production output decision of a single firm. The firm determines its rival's output level, evaluates the residual market demand, and then changes its own output level to maximize profits. It is assumed that the firm's output decision will not affect the output decision of its competitor.

For example, suppose that there are two firms in the market for toasters with a given demand function. Firm A will determine the output of Firm B, hold it constant, and then determine the remainder of the market demand for toasters. Firm A will then determine its profit-maximizing output for that residual demand as if it were the entire market, and produce accordingly. Firm B will be conducting similar calculations with respect to Firm A at the same time.

Bertrand Duopoly

The Bertrand model describes interactions among firms that compete on price. Firms set profit-maximizing prices in response to what they expect a competitor to charge. The model rests on the following assumptions:

- There are two firms producing homogeneous products;

- Firms do not cooperate;

- Firms compete by setting prices simultaneously; and

- Consumers buy everything from a firm with a lower price. If all firms charge the same price, consumers randomly select among them.

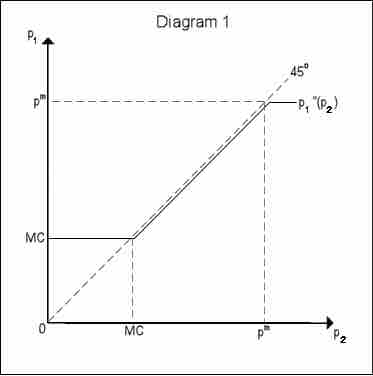

In the Bertrand model, Firm A's optimum price depends on where it believes Firm B will set its price . Pricing just below the other firm will obtain full market demand, though this choice is not optimal if the other firm is pricing below marginal cost, as this would result in negative profits. If Firm B is setting the price below marginal cost, Firm A will set the price at marginal cost. If Firm B is setting the price above marginal cost but below monopoly price, then Firm A will set the price just below that of Firm B. If Firm B sets the price above monopoly price, Firm A will set the price at monopoly level.

Bertrand Duopoly

The diagram shows the reaction function of a firm competing on price. When P2 (the price set by Firm 2) is less than marginal cost, Firm 1 prices at marginal cost (P1=MC). When Firm 2 prices above MC but below monopoly prices, Firm 1 prices just below Firm 2. When Firm 2 prices above monopoly price (PM), Firm 1 prices at monopoly level (P1=PM).

Imagine if both firms set equal prices above marginal cost. Each firm would get half the market at a higher than marginal cost price. However, by lowering prices just slightly, a firm could gain the whole market. As a result, both firms are tempted to lower prices as much as they can. However, it would be irrational to price below marginal cost, because the firm would make a loss. Therefore, both firms will lower prices until they reach the marginal cost limit. According to this model, a duopoly will result in an outcome exactly equivalent to what prevails under perfect competition. The result of the firms' strategies is a Nash equilibrium--a pair or strategies where neither firm can increase profits by unilaterally changing the price.

Colluding to charge the monopoly price and supplying one half of the market each is the best that the firms could do in this scenario. However, not colluding and charging the marginal cost, which is the non-cooperative outcome, is the only Nash equilibrium of this model.

The accuracy of the Cournot or Bertrand model will vary from industry to industry. If capacity and output can be easily changed, Bertrand is generally a better model of duopoly competition. If output and capacity are difficult to adjust, then Cournot is generally a better model.