The Coase Theorem, named after Nobel laureate Ronald Coase, states that in the presence of an externality, private parties will arrive at an efficient outcome without government intervention. According to the theorem, if trade in an externality is possible and there are no transaction costs, bargaining among private parties will lead to an efficient outcome regardless of the initial allocation of property rights .

Efficient Solution

According to the Coase theorem, two private parties will be able to bargain with each other and find an efficient solution to an externality problem.

Imagine a farm and a ranch next to each other. The rancher's cows occasionally wander over to the farm and damage the farmer's crops. The farmer has an incentive to bargain with the rancher to find a more efficient solution. If it is more efficient to prevent cattle trampling a farmer's field by fencing in the farm, rather than fencing in the cattle, the outcome of the bargaining will be the fence around the farm.

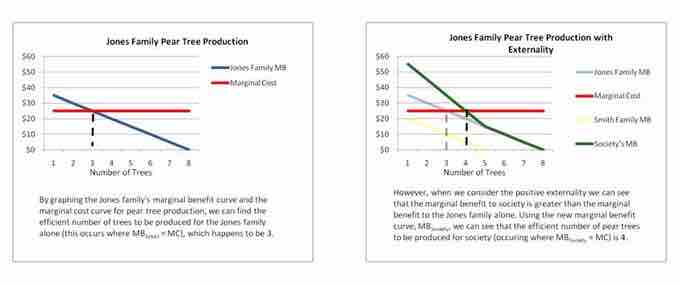

Take another example. The Jones family plants pear trees on their property which is adjacent to the Smith family. The Smith family gets an external benefit from the Jones family's pear trees because they pick up the pears that fall on the ground on their side of the property line (see ). This is an externality because the Smith family does not pay the Jones family for the utility received from gathering fallen pears. As a result, the Jones family plants too few pear trees. In response, the Jones family can put up a net that will prevent pears from falling on the Smith's side of the property line, eliminating the externality. Alternatively, the Jones could impose a cost on the Smith family if they want to continue to enjoy the pears from the pear trees. Both parties will be better off if they can agree to the second scenario, as the Smith family will continue to enjoy pears and the Jones family can increase the production of pears.

Effects of Externalities

This graph exemplifies how Coase's Theorem functions in a practical manner, underlining the effects of an externality in an economic model.

In practice, transaction costs are rarely low enough to allow for efficient bargaining and hence the theorem is almost always inapplicable to economic reality.