Taxes are a market-based policy option available to the government to address externalities. A corrective tax (also called a Pigovian tax) is applied to a market activity that is generating negative externalities (costs for a third party). The tax is set equal to the value of the negative externality and provides incentives for allocation of resources closer to the social optimum.

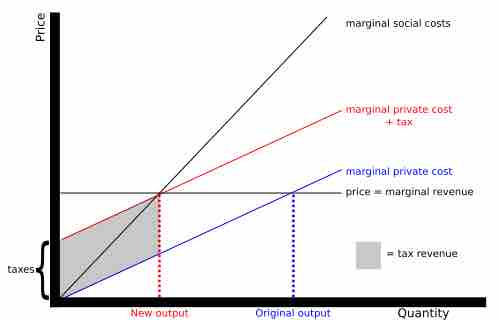

In the case of negative externalities, the social cost of an activity is greater than the private cost of the activity. In such a case, the market outcome is not efficient and may lead to overproduction of the good. Taxes make it more expensive for firms to produce the good or service generating the externality, thus providing an incentive to produce less of it . As the figure demonstrates, a tax shifts the marginal private cost curve up. In response, producers change the output to the socially-optimum level.

Corrective Tax

A tax shifts the marginal private cost curve up by the amount of the tax. This gives producers an incentive to reduce output to the socially optimum level.

Take environmental pollution as an example. The private cost of pollution to a polluter is less than its social cost. If the government levies a tax on pollution, it increases the polluter's private cost. The polluter now has an incentive to generate less pollution.

The level of the corrective tax is intended to counterbalance the externality. In practice, however, it is extremely difficult for the government to determine the appropriate level for the tax. Moreover, in determining the tax level, the government might come under pressure from various interest groups that would benefit from a higher or lower taxation level. Nevertheless, by introducing corrective taxes in response to negative externalities the government can not only increase efficiency, but raise revenues as well.