Recent growth in overall income inequality has been driven mostly by increasing inequality in wages and salaries. Globalization has contributed to some portion of rising inequality as jobs have moved to lower wage geographies, placing downward pressure on wages of higher cost of living countries. However, economists view the impact of technological progress to outweigh the effect of globalization, as technology has effectively been substituted for more expensive wage labor. Policy reforms and regressive taxation have promoted disparity but are relatively minor contributors to existing inequality. Discrimination and favoritism in the workplace has continued to limit advancement of minority groups and women, but evidence reveals that wage related impacts to marginalized groups diminish with the increase in educational attainment.

Common factors thought to impact domestic economic inequality include:

- Labor market outcomes

- Globalization

- Technological changes

- Policy reforms

- More regressive taxation

- Discrimination

Globally, income inequality has increased over the last few decades. In the U.S., recent studies have stated that the wealthiest 400 Americans control nearly 50% of domestic wealth. Given that economic theory points to a decline in income inequality over time, the recent increase has led many researchers to conclude that we may be starting a new inequality cycle .

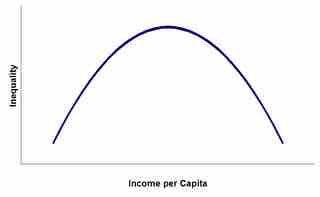

Kuznets curve

The Kuznets curve depicts the relationship between inequality and income; after hitting a market peak, inequality will decrease as income increases. Recent economic trends have caused researchers to believe that the economy may have started on a new Kuznet's curve given the heightening economic inequality.

Role of Government

The market for labor is not completely transparent, competition is imperfect, information unevenly distributed, opportunities to acquire education and skills unequal, and since many such imperfect conditions exist in virtually every market, there is in fact little presumption that markets are in general efficient. This means that there is an enormous potential role for government to correct these market failures.

Governments have a number of tools with which they can affect income distribution. One way in which governments attempt to decrease income inequality is through progressive taxation. Wealthier people pay proportionally more of their income in taxes, which are then used to pay for services for the poor. Government can also place regulations of hiring and firing practices to address issues such as discrimination.