Government Failure

Government failure, also known as non-market failure, is the public sector version of market failure . The market fails and government intervention causes a more inefficient allocation of goods and resources than would occur without the intervention. It occurs when the market inadequacies are not compared and analyzed against possible interventions before action is taken. Government failure can be described as providing "only limited help in prescribing therapies for government success. "

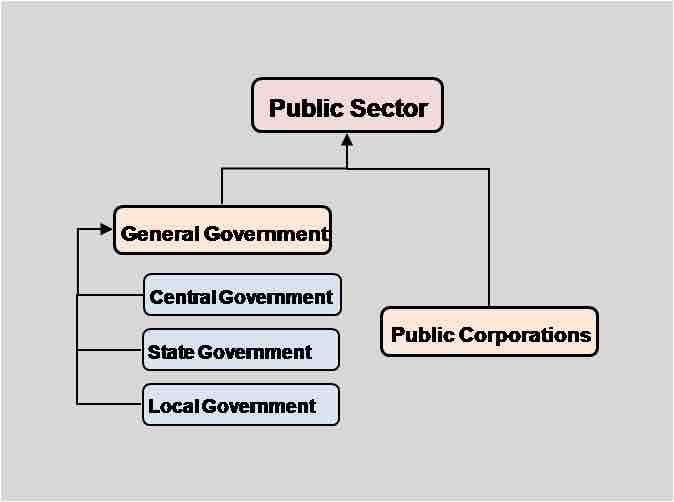

The Public Sector

This graph shows the layers of the government. The government is tied directly to the public sector. Government failure is an analogy made by the public sector when market failure occurs.

A government failure is not the failure of the government to enact a solution to a failure, but rather it is a systematic problem that prevents an efficient government solution to the problem. Government failures can occur in relation to both supply and demand within a market. Demand failures are the result of preference/revelation problems and the imbalance of voting and collective behavior. Supply failures are usually the result of principal-agent problems. In this case, the failure occurs in trying to get one party (agent) to work in the best interest of another party (principal).

Economic Crowding Out

There are specific scenarios that are directly associated with government failure. Economic crowding out occurs when the government expands its borrowing to pay for increased expenditure or tax cuts. The expanded borrowing is in excess of its revenue which crowds out private sector investment due to higher interest rates. Government spending also crowds out private spending.

Government Regulation

When analyzing government failure, inefficient regulation contributes to market failure. The are three specific regulatory inefficiencies:

- Regulatory arbitrage occurs when a regulated institution takes advantage of the difference between its real risk and the regulatory position.

- Regulatory capture occurs when regulatory agencies co-opt whether its the members or the entire regulated industry. Mechanisms that allows regulatory capture include rent seeking and rational ignorance.

- Regulatory risk is a risk faced by private sector firms when there is a chance that regulatory changes will negatively affect their business.

Recent evidence has suggested that even when democracies are economically stable, transparency, media freedom, and a larger government all contribute to increased government corruption. Government corruption leads to both market and government failure.