When governments want to ensure their citizens have access to healthy foods at reasonable prices, a variety of governmental supports are provided to the industry to ensure it maintains low costs of production and high output. This is generally in the form of subsidy and income supports, which alleviate some competitive dynamics and operating expenses to maintain reasonable price points in the market economically.

Subsidies

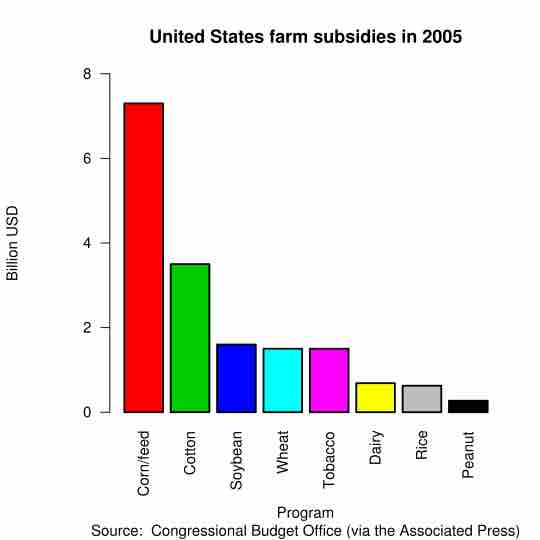

An agricultural subsidy is defined as a government grant paid to farmers to supplement income and influence the overall cost and supply of certain commodities. In this industry, subsidized goods generally include wheat, corn, barley, oats, sorghum, milk, rice, peanuts, tobacco, soybean, cotton, lamb, beef, chicken and pork. illustrates the governmental priorities, based upon subsidies provided, for specific agricultural goods in the United States. These subsidies play a large role in enabling higher supply at lower price points, supporting the domestic agricultural industry.

Agriculture Subsidies in the U.S. (2005)

This chart illustrates the governmental priorities, based upon subsidies provided, for specific agriculture goods in the United States.

Another, less direct, form of subsidy is in the taxing system for consumers. Consumers are not charged tax on food goods and clothes, which are considered necessities and thus should be provided at the lowest costs possible. These consumer-based subsidies are another governmental attempt to enable citizens in the country to purchase basic food stuffs required to survive. Food stamps are a similar concept, used to empower low income individuals and ensure they have access to these basic foods as well (food stamps are often limited to milk, eggs, bread and other core foods).

Impacts of Subsidies

While these subsidies above are designed to have a positive effect on consumers looking to purchase foods, there are externalities to this process that can have a damaging affect on other groups:

- Global Effects: While domestic subsidies are good for driving up production domestically, it suppresses competition in the context of international trade. Government assistance in an industry is argued to provide an unfair competitive advantage for those companies, artificially lowering their costs of production, sometimes below the feasible level for countries (especially developing nations) not receiving these supports.

- Developing Nations: A complement to the above discussion is the effect on poverty and developing nations without the infrastructure to provide subsidies for their own farmers. The International Food Policy Research Institute has estimated a total loss of economic growth in developing nations at $24 billion in 2003, all of which translate to lost income for individuals who desperately need it.

- Nutrition: Another interesting side effect of subsidies and the artificially reduced price of food is obesity and overeating. Some argue that these low prices provide the incentive to buy more food than is necessary, and this over consumption has resulted in a highly unhealthy culture (particularly in the U.S.).

- Environmental Implications: As food prices reduce distribution increases, thus driving an environmental externality which already existed even further. The cost, environmentally, of transporting a high quantity of agricultural goods across the globe has resulted in high degrees of pollution and waste.

Overall, while subsidies are largely a good thing and enable individuals to buy the necessities, there are clear cut downsides to subsidies as well. Politics must find a way to mitigate the negative consequences while increasing the positive effects, allowing for balanced and healthy consumption across all demographics.