The Fiscal Multiplier and the Multiplier Effect

In economics, the fiscal multiplier is the ratio of change in the national income in relation to the change in government spending that causes it (not to be confused with the monetary multiplier). National income can change as a direct result in a change in spending whether it is private investment spending, consumer spending, government spending, or foreign export spending. When the fiscal multiplier exceeds one, the resulting impact on the national income is called the multiplier effect.

Cause of the Multiplier Effect

The multiplier is influenced by an incremental amount of spending that leads to higher consumption spending, increased income, and then even more consumption. As a result, the overall national income is greater than the initial incremental amount of spending. Simply put, an initial shift in aggregate demand may cause a change in aggregate output (as well as the aggregate income it creates) that is a multiplier of the initial change.

Use of the Multiplier Effect

The multiplier effect is a tool that is used by governments to attempt to stimulate aggregate demand in times of recession or economic uncertainty . The government invests money in order to create more jobs, which in turn will generate more spending to stimulate the economy. The goal is that the net increase in disposable income will be greater than the original investment.

1953 U.S. Recession

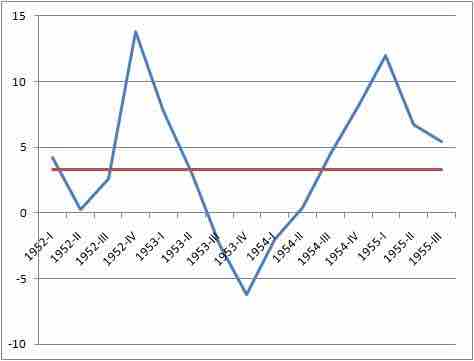

This graph shows the economic recession that occurred in the U.S. in 1953. During recessions, the government can use the multiplier effect in order to stimulate the economy.

Criticisms

Although the multiplier effect usually measures values of one, there have been cases where multipliers of less than one are measured. This suggests that types of government spending can crowd out private investment or consumer spending that would have taken place without the government spending. Crowding out can occur because the initial increase in spending can cause an increase in the interest rates or the price level.

It has been argued that when a government relies heavily on fiscal multipliers, externalities such as environmental degradation, unsustainable resource depletion, and social consequences can be neglected. Over reliance on fiscal multipliers can cause increased government spending on activities that create negative externalities (pollution, climate change, and resource depletion) instead of positive externalities (increased educational standards, social cohesion, public health, etc.).