Aggregate demand (AD) is the total demand for all goods within a given market at a given time, or the summation of demand curves within a system. Understanding the basic graphical representation of this curve is useful in grasping the implications of AD on an economic system, as well as the distinct effects which drive it. As a result of Keynes' interest rate effect, Pigou's wealth effect, and the Mundell-Fleming exchange rate effect, the AD curve is downward sloping.

Keynes' Interest Rate Effect

The critical point from Keynes's perspective on the slope of the aggregate demand curve is that interest rates affect expenditures more than they affect savings. If prices fall, a given amount of money will increase in value. This will drive up interest rates and investments. It is important to note that insufficient demand in a market will not go on forever.

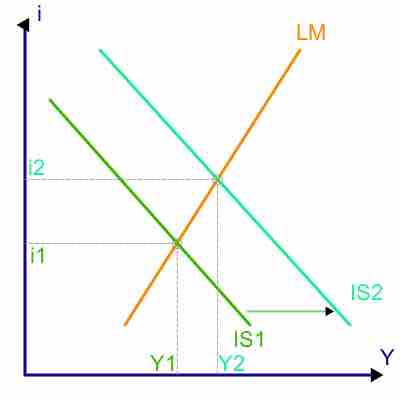

In understanding this fully, it is useful to look at an IS-LM graph (see ). There are only two times when the Keynes observation on the interest rate effect will be inaccurate, and that is if the IS (investment savings) curve were to be vertical or if the LM (liquidity preference money supply) curve were to be horizontal. This makes sense if you think about it, it would basically equate to a liquidity trap. A vertical IS curve or a horizontal LM curve would essentially negate the way in which interest rates could affect aggregate demand.

IS-LM Model

The IS-LM model takes investments and savings and compares that to liquidity and the overall money supply. It is highly useful in understanding macroeconomics from a Keynesian perspective. Interest rates (i) are on the vertical axis, and output (y) is on the horizontal axis.

Pigou's Wealth Effect

In the context of the above discussion on Keynes, Pigou's Wealth Effect underlines the fact that liquidity traps are not sustainable. The simplest way to explain the Wealth Effect is that an increase in spending will denote an increase in wealth. In many ways, what Pigou is putting forward is the idea that downwards spiral on the IS-LM model , as predicted by Keynes due to deflation, will be counterbalanced by an increase in real wages and thus an increase in expenditure. In other words, a decrease in employment and prices will eventually see higher purchasing power and an increase in spending, creating wealth.

Mundell-Fleming Exchange Rate Effect

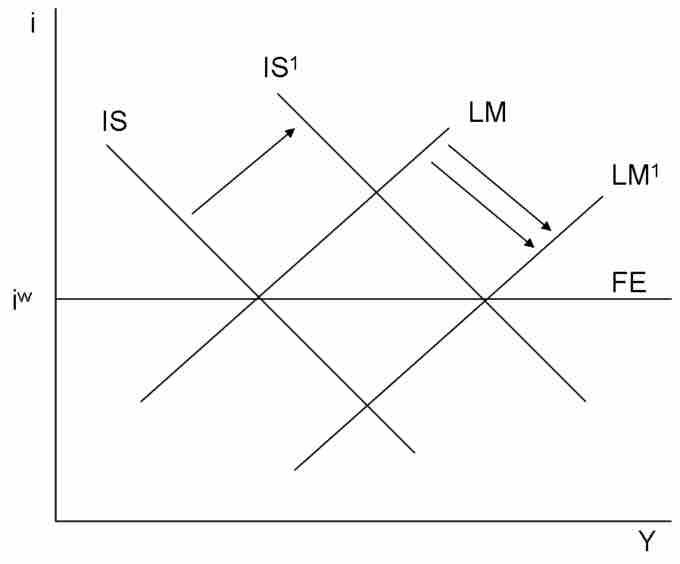

Perhaps the most complex of the three inputs underlined in deriving aggregate demand is the Mundell-Fleming Exchange Rate Effect. Just like the previous two, this builds off of the IS-LM model in a way that discusses it in the context of an open economy (as opposed to a closed system). It essentially takes into account a new factor (in addition to interest rates and outputs, as the traditional IS-LM model incorporates). This new factor is the exchange rates, as the name implies. Robert Mundell and Marcus Fleming noted that incorporating the nominal exchange rate into the mix makes it impossible to maintain free capital movement, a fixed exchange rate and independent monetary policy. This is sometimes referred to as the 'impossible trinity,' implying that trade-offs must be made. This concept is illustrated fairly well in this figure , where 'FE' is fixed expenditure.

Mundell-Fleming Fixed Exchange Rate Illustration

An increase in government spending forces the monetary authority to supply the market with local currency to keep the exchange rate unchanged. Shown here is the case of perfect capital mobility, in which the BoP curve (or, as denoted here, the FE curve) is horizontal.

Conclusion

While these varying effects make the concept of aggregate demand slopes seem somewhat complicated, the most important thing to keep in mind is that people will be demanding more goods when they are cheaper. The analysis of interest rates displayed above, through the wealth effect in particular, offsets the negative spiral that could occur as a result of deflation and decreased employment. These effects also play a crucial role in understanding the way in which the larger and more complex environment, including investments and fiscal and monetary policy, will retain this downwards slope.