The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from the Fed's lending facility, the discount window. The Fed offers three discount window programs to depository institutions: primary credit, secondary credit, and seasonal credit, each with its own interest rate. All discount window loans are fully secured.

Under the primary credit program, loans are extended for a very short term (usually overnight) to depository institutions in generally sound financial condition. Depository institutions that are not eligible for primary credit may apply for secondary credit to meet short-term liquidity needs or to resolve severe financial difficulties. Seasonal credit is extended to relatively small depository institutions that have recurring intra-year fluctuations in funding needs, such as banks in agricultural or seasonal resort communities.

The discount rate charged for primary credit (the primary credit rate) is set above the usual level of short-term market interest rates. (Because primary credit is the Federal Reserve's main discount window program, the Federal Reserve, at times, uses the term "discount rate" to mean the primary credit rate. ) The discount rate on secondary credit is above the rate on primary credit. The discount rate for seasonal credit is an average of selected market rates. Discount rates are established by each reserve bank's board of directors, subject to the review and determination of the Federal Reserve System's Board of Governors. The discount rates for the three lending programs are the same across all reserve banks except on days around a change in the rate.

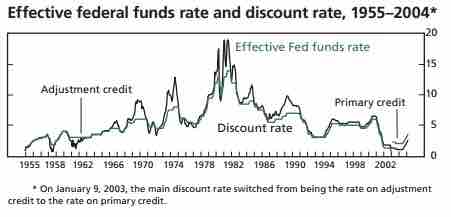

Discount rate

Effective Federal funds rate and discount rate, 1955-2004