The Federal Reserve supervises certain entities and has the statutory authority to take formal enforcement actions against them, including state member banks, bank holding companies, nonbank subsidiaries of bank holding companies, branches and agencies of foreign banking organizations operating in the United States and their parent banks, and officers, directors, employees, and certain other categories of individuals associated with the above banks, companies, and organizations.

Generally, the Federal Reserve takes formal enforcement actions against the above entities for violations of laws, rules, or regulations, unsafe or unsound practices, breaches of fiduciary duty, and violations of final orders. Formal enforcement actions include cease and desist orders, written agreements, removal and prohibition orders, and orders assessing civil money penalties.

Enforcement

If the Federal Reserve determines that a state member bank or bank holding company has problems that affect the institution's safety and soundness or is not in compliance with laws and regulations, it may take a supervisory action to ensure that the institution undertakes corrective measures. Typically, such findings are communicated to the management and directors of a banking organization in a written report. The management and directors are then asked to address all identified problems voluntarily and to take measures to ensure that the problems are corrected and will not recur.

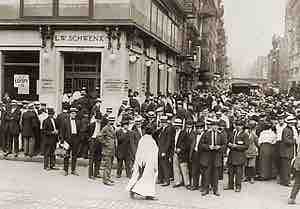

Bank failure

If the Federal Reserve determines that a state member bank or bank holding company has problems that affect the institution's safety and soundness or is not in compliance with laws and regulations, it may take a supervisory action to ensure that the institution undertakes corrective measures.

Most problems are resolved promptly after they are brought to the attention of an institution's management and directors. In some situations, however, the Federal Reserve may need to take an informal supervisory action, requesting that an institution adopt a board resolution or agree to the provisions of a memorandum of understanding to address the problem. If necessary, the Federal Reserve may take formal enforcement actions to compel the management and directors of a troubled banking organization, or persons associated with it, to address the organization's problems. For example, if an institution has significant deficiencies or fails to comply with an informal action, the Federal Reserve may enter into a written agreement with the troubled institution or may issue a cease-and-desist order against the institution or against an individual associated with the institution, such as an officer or director. The Federal Reserve may also assess a fine, remove an officer or director from office and permanently bar him or her from the banking industry, or both.