Services from Non-Bank Financial Institutions

A non-bank financial institution (NBFI) is a financial institution that does not have a full banking license or is not supervised by a national or international banking regulatory agency. NBFIs facilitate bank-related financial services, such as investments, risk pooling, contractual savings, and market brokering. Examples of these include insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. Alan Greenspan has identified the role of NBFIs in strengthening an economy, as they provide "multiple alternatives to transform an economy's savings into capital investment which act as backup facilities should the primary form of intermediation fail. "

Financial services are equally important in protecting against the unforeseen consequences of natural disasters, war, illness, incapacity or death of a breadwinner, and other crises. With financial services, poor families can send their children to school, buy medicine, and get through lean times when cash and food are scarce. Despite the importance of financial services for both poverty reduction and equitable economic growth, experts estimate that only five percent of low-income households around the world have access to such services. The international development community, with a vision it calls "financial sector deepening," is promoting the extension of diverse financial services by a wide range of bank and non-bank financial institutions to ever larger numbers of low-income and middle-class households around the world.

High-Cost Loans

You have probably seen ads for check-cashing stores, payday loans, and rent-to-own stores. You may be intrigued by the services they offer. But these short-term financial fixes can cost you big bucks because they are ostensibly high-cost loans. Make sure you understand what you're agreeing to and can afford to pay back your loan before you sign any documents. Consider your options to taking a high-cost loan and use loans wisely.

Check-Cashing Establishments

If you don't have a checking or savings account, you might think check-cashing stores are a convenient alternative. Understand, however, check-cashing stores charge you for that convenience. Many check-cashing stores charge a fee of $4 for every $100 on a payroll check. That means if you have a $700 payroll check, you're paying $28 just to cash it. For $28 you might be able to fill your car with gas or buy groceries. For personal checks, these establishments charge even more .

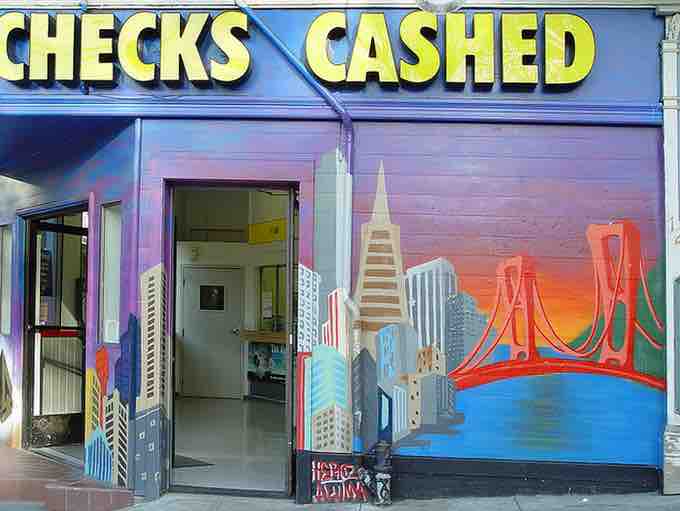

Mural: Checks Cashed

Check-cashing institution on Haight Street, San Francisco, California

Payday Lenders

Many check-cashing stores also make payday loans. A payday loan is a small, high-interest, short-term cash loan. In most cases, you write a post-dated, personal check for the advance amount, plus a fee. The payday lender holds the check for the loan period and then deposits it, or you return with cash to reclaim the check. Although a payday loan may be a convenient short-term solution, it is not a good idea for long-term cash needs. You run the risk of getting into a payday loan cycle of debt by taking out loan after loan