Commercial banks are financial institutions that focus on enabling the exchange of capital and currency via a variety of services. For the most part, the term commercial bank refers to divisions of banks that deal primarily with mid-sized to large businesses.

Banking Commercially

When considering commercial banks, it's useful to understand that they act as an outlet for strategic financial decisions for businesses to offset certain risks, procure resources, invest, and store assets. These services generally include the following:

- Enabling bank accounts, used to store, exchange, send, and receive capital electronically (generally via the internet)

- Providing loans and other lending services, at established rates of interest

- Safekeeping of documents and valuables via safe deposit boxes

- Enabling the purchase of a wide variety of investment options

- Risk management (i.e. foreign exchange risks, interest rates, hedging commodities, derivatives)

- Project financing

- Raising capital (i.e. IPOs and other forms of commercial capital raising)

While banks offer other services in addition to these, the primary function of commercial banks is to act as a critical resource for businesses to access capital, enable investments, and mitigate risks.

Banking Risks and Economic Issues

Banking is, in many ways, in the business of risk. It is in measuring these risks that banks determine their interest rates and fees. There are a few types of risks banks encounter, which are useful in understanding how banks function:

- Credit Risk – Risk that a borrower may not return the entirety of the payment owed.

- Liquidity Risk – Risk that an acquired asset cannot be traded quickly enough to capture profit.

- Market Risk – Virtually any capital asset has a market, and is therefore subjected to the risks of it's respective market.

- Operational Risk – Risk that an operational issue will diminish returns.

- Reputation Risk – Risk that a company's trustworthiness will decline.

- Macroeconomic Risk – Risk that the broader economy will decline.

The economic collapse in 2008, partly as a result of banks failing to accurately identify and ethically respond to risk, is a strong example of the consequences of banking failures.

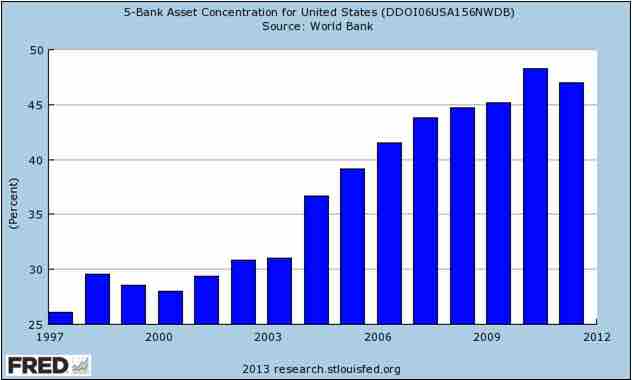

Percent of Industry Assets Owned by the Largest 5 Banks

This image demonstrated the ongoing consolidation of the banking industry, through displaying the overall assets owned by the largest 5 banks.