The Importance of COGS

The cost of goods sold (COGS) is a highly relevant indicator for the health of business operations, as it is a variable cost directly applied to each item sold on a per unit basis. This calculation allows the business to see just how much it costs to source, product, inventory, manage, and distribute organizational products and services. From a general strategic point of view, the COGS when compared to the consumer willingness to pay is the key indication of whether or not the production of a certain product (at a certain volume) will yield long-term sustainable profits.

How COGS is Derived

When viewing an income statement, it is useful to recall that the flow of information is top-down. At the top of the income statement is overall revenues, which are immediately applied to the cost of goods sold. This initial calculation will take into account the following costs of production:

- Sourcing of raw materials, parts and supplies used

- All labor directly involved in the production, manufacturing, and delivery of the product/service, including the benefits and payroll taxes

- All overhead directly applicable to the production process (i.e. electricity to run machines, rent for the manufacturing facility, rent for the warehouses, salaries of factory management, etc.)

- All storage and warehousing of products/services, alongside the distribution to consumers (i.e. shipping, storing, handling)

In short, COGS refers to the cost of producing the good from start to finish. This does NOT include support activities such as corporate marketing, corporate HR, senior management (unless they are actively on the production floor), IT infrastructure (unless directly integrated with manufacturing) and other sales, general, and administrative costs.

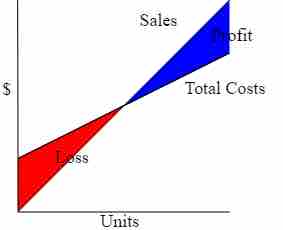

Break-even Point

The cost of goods sold often determines at what level of output (in terms of units) will produce a break-even point at the given price point the item is being sold.

Recording Methodologies

When applying this information to the income statement, different accounting tactics are used depending upon the situation of the organization. A few key record keeping concepts to keep in mind when approaching COGS:

First-In, First-Out (FIFO) - Under this COGS tracking method, the first items to be produced are the ones that are sent off the shelves first. Picture a smartphone manufacturer, where the first 50 cost $200 to produce and the second 50 cost $300 to produce. After selling the first 50 phones, the COGS under FIFO would be $10,000 (50 x $200).

Last-In, First-Out (LIFO) - Under this COGS method, the last items produced are the ones that are sent off the shelves first. So, to use the above example, the sale of the first 50 phones would have a recorded COGS of $15,000 (50 x $300).

Average Cost - Under this COGS method, the overall per unit production cost is averaged across the entire recording period. That is to say that the total COGS per unit will simply be the overall cost of all operations (during reporting period)/production volume (during reporting period). This is particularly helpful for homogeneous goods.

Specific Identification - As an antithesis to average cost calculations, this method tracks each individual item and prices the COGS according to its individual production process. This can be valuable when producing specialized and differentiated goods, which don't always sell at the same price or compare cleanly to one another.