Influencing Economic Activity Through Policy

In every country, the government takes steps to help the economy achieve the goals of growth, full employment, and price stability.

In the United States, the government influences economic activity through two approaches:

- Monetary policy

- Fiscal policy

Through monetary policy, the government exerts its power to regulate the money supply and level of interest rates. Through fiscal policy, it uses its power to tax and to spend.

Monetary Policy and the Fed

Monetary policy is exercised by the Federal Reserve System ("the Fed"), which is empowered to take various actions that decrease or increase the money supply and raise or lower short-term interest rates, making it harder or easier to borrow money.

When the Fed believes that inflation is a problem, it will use contractionary policy to decrease the money supply and raise interest rates. In theory, when rates are higher, borrowers have to pay more for the money they borrow, and banks are more selective in making loans. Because money is "tighter"more expensive to borrow–demand for goods and services will go down, and so will inflation.

To counter a recession, the Fed uses expansionary policy to increase the money supply and reduce interest rates. With lower interest rates, it's cheaper to borrow money, and banks are more willing to lend it. We then say that money is "easy. " Attractive interest rates encourage businesses to borrow money to expand production and encourage consumers to buy more goods and services.

The Tools of Monetary Policy

Since the 1970s, monetary policy has generally been formed separately from fiscal policy. Even prior to the 1970s, the Bretton Woods system still ensured that most nations would form the two policies separately.

Within almost all modern nations, special institutions (such as the Fed in the United States, the Bank of England, and the European Central Bank) exist which have the task of executing the monetary policy, often independently of the executive. In general, these institutions are called "central banks" and often have other responsibilities, such as supervising the smooth operation of the financial system. The beginning of monetary policy as such comes from the late nineteenth century, where it was used to maintain the gold standard.

Monetary policy rests on the relationship between the rates of interest in an economy (the price at which money can be borrowed) and the total money supply. Monetary policy uses a variety of tools to control one or both of these in order to influence economic growth, inflation, exchange rates, and unemployment.

Where currency is under a monopoly of issuance, or where there is a regulated system of issuing currency through banks which are tied to a central bank, the monetary authority has the ability to alter the money supply and, thus, influence the interest rate (to achieve policy goals).

Monetary Policy Tools

There are several monetary policy tools available to achieve these ends:

- Increasing interest rates by fiat

- Reducing the monetary base

- Increasing reserve requirements

All have the effect of contracting the money supply and, if reversed, expand the money supply.

The primary tool of monetary policy is open market operations. This entails managing the quantity of money in circulation through the buying and selling of various financial instruments, such as treasury bills, company bonds, or foreign currencies. All of these purchases or sales result in more or less base currency entering or leaving market circulation.

Usually, the short-term goal of open market operations is to achieve a specific short-term interest rate target. In other instances, monetary policy might instead entail the targeting of a specific exchange rate relative to some foreign currency or else relative to gold.

For example, in the case of the United States, the Fed targets the federal funds rate, the rate at which member banks lend to one another overnight; however, the monetary policy of China is to target the exchange rate between the Chinese renminbi and a basket of foreign currencies.

The other primary means of conducting monetary policy include:

- Discount window lending (lender of last resort)

- Fractional deposit lending (changes in the reserve requirement)

- Moral suasion (cajoling certain market players to achieve specified outcomes)

- "Open mouth operations" (talking monetary policy with the market)

Types of Monetary Policy

A policy is referred to as "contractionary," if it reduces the size of the money supply or increases it only slowly or if it raises the interest rate. An expansionary policy increases the size of the money supply more rapidly or decreases the interest rate.

Furthermore, monetary policies are described as follows: accommodative, if the interest rate set by the central monetary authority is intended to create economic growth; neutral, if it is intended neither to create growth nor combat inflation; or tight, if intended to reduce inflation.

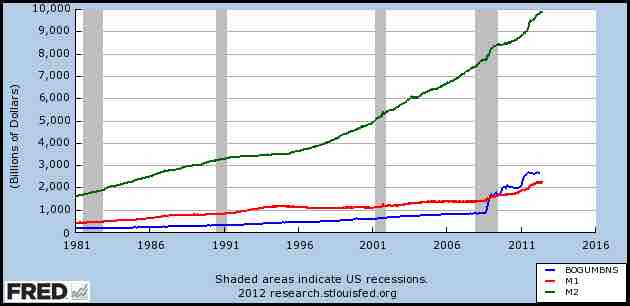

MB, M1 and M2 aggregates from 1981 to 2012

These are the aggregatges for MB, M1, and M2, as taken from the St. Louis Federal Reserve's aggregate graph generator.