Definition of a Liability

In financial accounting, a liability is defined as an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of future economic benefits. Liabilities are reported on the balance sheet, along with assets and owner's equity. They are an important part of the basic accounting equation -- assets = liabilities + owner's equity. A liability is defined by one of the following characteristics:

- A borrowing of funds from individuals or banks for improving a business or personal income that is payable during a short or long time period.

- A duty or responsibility to others that entails settlement by future transfer or use of assets, provision of services, or other transaction yielding an economic benefit, at a specified date, on occurrence of a specified event, or on demand.

- A duty or responsibility that obligates the entity to another entity, with no option to avoid settlement.

- A transaction or event that has already occurred and obligates the entity .

Definition of a Current Liability

A current liability can be defined in one of two ways: (1) all liabilities of the business that are to be settled in cash within a firm's fiscal year or operating cycle, whichever period is longer or (2) all liabilities of the business that are to be settled by current assets or by the creation of new current liabilities. Another important point is that current liabilities are many times not "current" and are actually past due. For example, accounts payable are due within 30 days and are typically paid within 30 days. However, they do often run past 30 days or 60 days in some situations. So, the accounts payable balance reported on the balance sheet under "current" liabilities may include amounts that are over 30 days due.

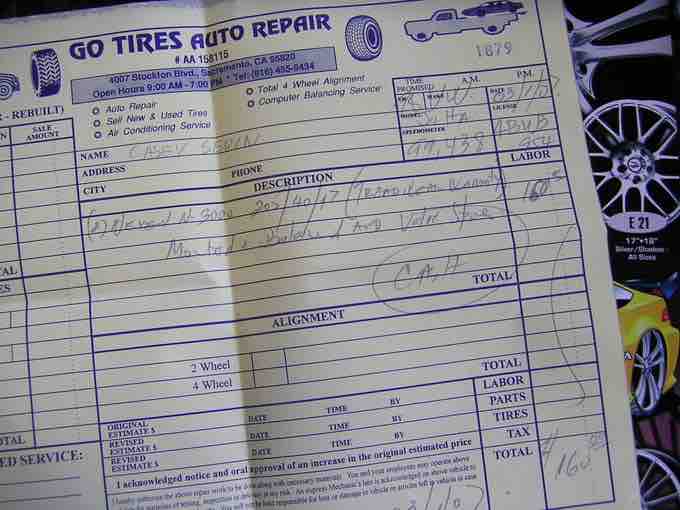

A current liability, such as a credit purchase, can be documented with an invoice.

Current liabilities are debt owed and payable no later than the current accounting period.