Definition of Accounts Payable

Accounts payable (A/P) is money owed by a business to its suppliers and creditors. It is typically shown on its balance sheet as a current liability. In addition to its disclosure on the balance sheet, accounts payable is recorded in the A/P sub-ledger at the time an invoice is vouchered for payment. Vouchered, or vouched, means that an invoice is approved for payment and has been recorded in the general ledger or A/P sub-ledger as an outstanding, or open, liability because it has not been paid. Payables are often categorized as trade payables, or purchases of physical goods that are recorded in inventory. Another category is expense payables, or purchases of goods or services that are expensed. Common examples of expense payables are advertising, travel, entertainment, office supplies, and utilities. A/P is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has been received. Suppliers offer various payment terms for an invoice .

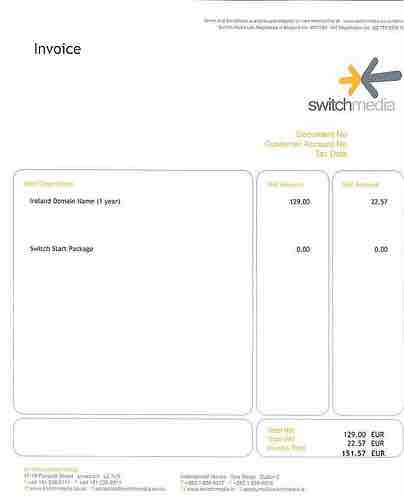

An invoice payable in 30 days is typically recorded as accounts payable.

In most businesses, accounts payable is a common type of current liability.

Processing Accounts Payable

A/P payment terms may include the offer of a cash discount for paying an invoice within a defined number of days. For example, the 2/10 Net 30 term means that the seller will deduct 2% from the invoice total if payment is made within 10 days and the invoice must be paid within 30 days. If the payment is delayed until Day 31 then the full amount of the invoice is due and past due charges may apply. As invoices are paid, the amounts are recorded as reductions to the accounts payable balance in the liability section and cash in the assets section of the balance sheet. The A/P payment process begins as an invoice is received by the purchaser and matched to a packing (receiving) slip and purchase order. When the three documents are matched, the invoice is paid. This is referred to as the three-way match. The three-way match can be modified to expedite payments. For example, three-way matching may be limited solely to large-value invoices, or the matching is automatically approved if the received quantity is within a certain percentage of the amount authorized in the purchase order.