Revenue Recognition Principle

The revenue recognition principle and the matching principle are two cornerstones of accrual accounting. They both determine the accounting period, in which revenues and expenses are recognized. According to the revenue recognition principle, revenues are recognized when they are realized or realizable and earned—usually when goods are transferred or services rendered—regardless of when cash is received. In contrast, cash accounting revenues are recognized when cash is received regardless of when goods or services are sold. Cash can be received before or after obligations are met—when goods or services are delivered. Related revenues as two types of accounts:

- Accrued revenue: Revenue is recognized before cash is received.

- Deferred revenue: Revenue is recognized after cash is received.

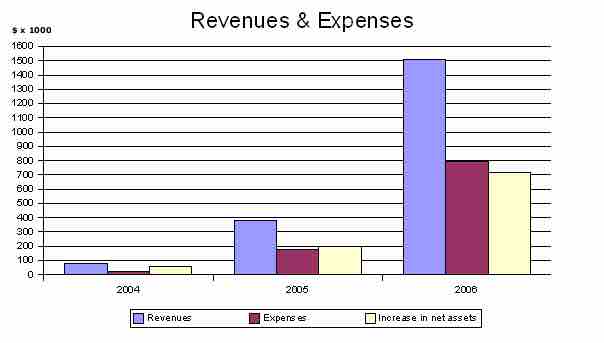

Revenues and Expenses

This graph shows the growth of the revenues, expenses, and net assets of the Wikimedia Foundation from june 2003 to june 2006.

Accruals and Deferrals: Timing of Recognition vs. Cash Flow

Two types of balancing accounts exist to avoid fictitious profits and losses. These might occur when cash is not paid out in the same accounting period in which expenses are recognized. According to the matching principle in accrual accounting, expenses are recognized when obligations are incurred—regardless of when cash is paid out. In contrast to recognition is disclosure. An item is disclosed when it is not included in the financial statements, but appears in the notes of the financial statements. Cash can be paid out in an earlier or later period than the period in which obligations are incurred. Related expenses result in the following two types of accounts:

- Accrued expense: Expense is recognized before cash is paid out.

- Deferred expense: Expense is recognized after cash is paid out.

Accrued expenses are a liability with an uncertain timing or amount; the uncertainty is not significant enough to qualify it as a provision. One example would be an obligation to pay for goods or services received from a counterpart, while the cash is paid out in a later accounting period—when its amount is deducted from accrued expenses. Accrued expenses shares characteristics with deferred revenue. One difference is that cash received from a counterpart is a liability to be covered later; goods or services are to be delivered later—when such income item is earned, the related revenue item is recognized, and the same amount is deducted from deferred revenues.

Deferred expenses, or prepaid expenses or prepayment, are an asset. These expenses include cash paid out to a counterpart for goods or services to be received in a later accounting period—when fulfilling the promise to pay is actually acknowledged, the related expense item is recognized, and the same amount is deducted from prepayments. Deferred expenses share characteristics with accrued revenue. One difference is that proceeds from a delivery of goods or services are an asset to be covered later, when the income item is earned and the related revenue item is recognized; cash for the items is received in a later period—when its amount is deducted from accrued revenues.

The Matching Principle

The matching principle is a culmination of accrual accounting and the revenue recognition principle. They both determine the accounting period, in which revenues and expenses are recognized. According to the principle, expenses are recognized when obligations are:

- Incurred (usually when goods are transferred or services rendered—e.g. sold)

- Offset against recognized revenues, which were generated from those expenses (related on the cause-and-effect basis), regardless of when cash is paid out. In cash accounting, on the other hand, expenses are recognized when cash is paid out, regardless of when obligations are incurred through transfer of goods or rendition of services.

If no cause-and-effect relationship exists (e.g., a sale is impossible), costs are recognized as expenses in the accounting period they expired—when have been used up or consumed. Prepaid expenses are not recognized as expenses, but as assets until one of the qualifying conditions is met resulting in a recognition as expenses. If no connection with revenues can be established, costs are recognized immediately as expenses (e.g., general administrative and research and development costs).

Prepaid expenses, such as employee wages or subcontractor fees paid out or promised, are not recognized as expenses (cost of goods sold), but as assets (deferred expenses), until the actual products are sold.

The matching principle allows better evaluation of actual profitability and performance. It reduces noise from the timing mismatch between when costs are incurred and when revenue is realized. Keep in mind that recent standards have moved away from matching expenses and revenues in favor of "balance sheet" model of reporting.