Overview of a Statement of Cash Flows

The money coming into the business is called cash inflow, and money going out from the business is called cash outflow. To show the affects on the inflows and outflows on a company, a statement of cash flow is used. The statement of cash flows is a cash basis report on three types of financial activities: operating activities, investing activities, and financing activities. Any non-cash activities are usually reported in footnotes.

Purpose of a Statement of Cash Flows

The cash flow statement is intended to provide information on a firm's liquidity and solvency. The statement of cash flows show the company's ability to change cash flows in future circumstances. The statement of cash flows also reconciles the cash balance from one balance sheet to the next. It provides additional information for evaluating changes in assets, liabilities and equity . The statement of cash flows makes it easier to compare different companies, because it eliminates allocations (such as depreciation). In essence, it helps assess how well the expected payments are being realized as cash.

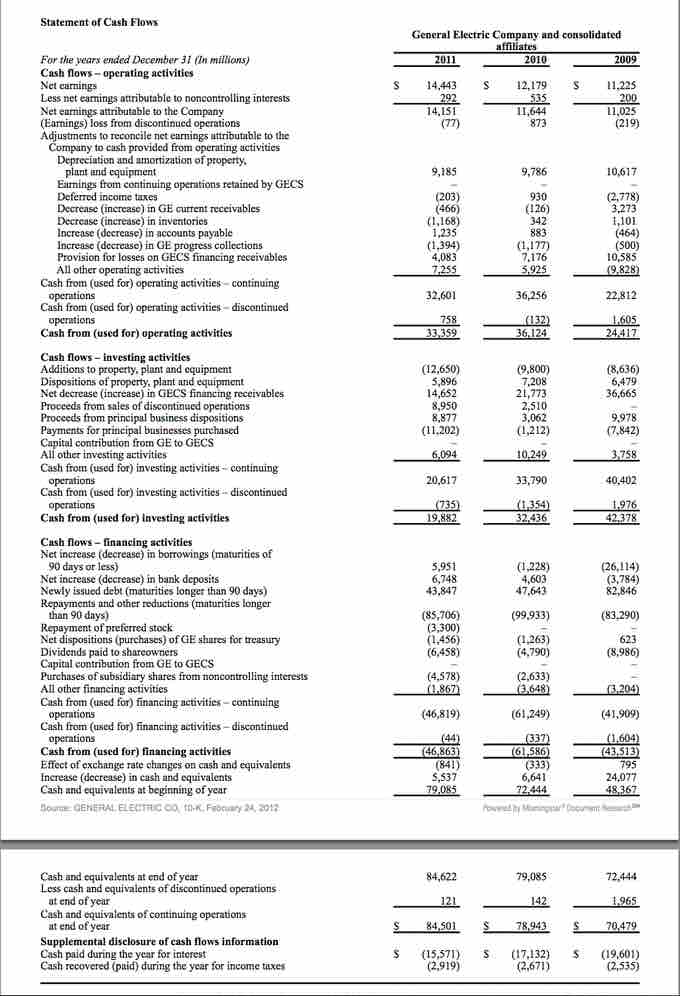

Statement of Cash Flows

The statement of cash flows shows the liquidity of a company.

Contrasting Income Statement to the Statement of Cash Flows

The income statement is accrual based. It shows net income, which is calculated as follows: revenues earned minus the expenses incurred in order to earn those revenues. For example, a company earns revenues in April, but allows customers 30 days to pay, so the cash from April sales will not be received until May.The same for expenses, while inventory bought in April might not sell until May, the inventory was bought and paid for in April.

The statement of cash flows is cash based and it shows the actual inflows and outflows of cash for the given month.

Items on the Statement of Cash Flows

The cash flow statement includes only inflows and outflows of cash and cash equivalents. The statement of cash flows excludes transactions that do not directly affect cash receipts and payments. These non-cash transactions include depreciation or write-offs on bad debts or credit losses. The Statement of Cash Flows is composed of three sections:

- Operating Activities. These include the cash inflows and outflows of all transactions related to core activities of the business.

- Investing Activities. Investing activities include all transactions related to the acquisition or disposal of non-current assets. Non-current assets is another term for fixed assets, which includes all property that cannot be easily converted to cash. It also can refer to investments in other companies.

- Financing Activities. Financing activities includes all transactions related to changes in the amount of a business's equity available for sale or the amount of the business's outstanding debt, with the exception of interest payments.

Users of a Statement of Cash Flows

- Accounting personnel, who need to know whether the organization will be able to cover payroll and other immediate expenses

- Potential investors, who need to judge whether the company is financially sound

- Potential employees or contractors, who need to know whether the company will be able to afford compensation

- Shareholder's of the business