Since most businesses operate using accrual basis accounting, expense recognition is guided by the matching principle. For an expense to be recognized, the obligation must be both incurred and offset against recognized revenues.

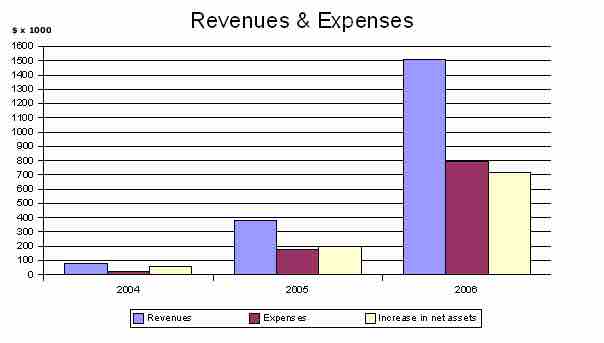

Revenues and Expenses

This graph shows the growth of the revenues, expenses, and net assets of the Wikimedia Foundation from june 2003 to june 2006.

Incurred

An expense is incurred when the underlying good is delivered or service is performed. For example, assume a company enters into a contract with a supplier for the delivery of 1,000 units of raw material that will be used to produce the goods it sells. Two weeks later, the raw material is delivered to the company's warehouse. Two weeks after that, the company pays the outstanding obligation. Under the matching principle, the expense related to the raw material is not incurred until delivery.

Offset Against Recognized Revenues

Generally, an expense being incurred is insufficient for it to be recognized. If the cost can be tied to a revenue generating activity, it will not be recognized as an expense until the associated good or service is sold.

Using the same example from above, the delivery of the raw material is insufficient to cause the cost of those goods to be recognized as an expense. The raw material will be used to make items that will be sold to the public. When the items that used the raw materials are sold, then the costs related to the raw material are recognized.

No Cause and Effect

The matching principle assumes that every expense is directly tied to a revenue generating event, such as a production of a good or service. This is not always the case. When these expenses are recognized depends on what goods or services are related to the cost in question.

If a company generates goods or services that it cannot sell, the costs associated with producing those items become expenses when the items become used up or consumed. So if a business produced substandard goods that it could not sell or the good becomes spoiled, the production costs would be expensed as soon as it became clear that the item could not be sold.

If a cost is not directly tied to any revenue generating activity, it is recognized as soon as it is incurred. Examples of such costs include general administration and research and development.