Income Statement

The income statement is one component of the financial statements for a company. It can also be referred to as an earnings statement, profit and loss statement, or operating statement . The income statement reports the profitability of a business organization for a stated period, such as a month or a year. These time periods are usually of equal length so that statement users can make valid comparisons of a company's performance from period to period. Profitability is measured by comparing the revenues earned with the expenses incurred to produce the revenue.

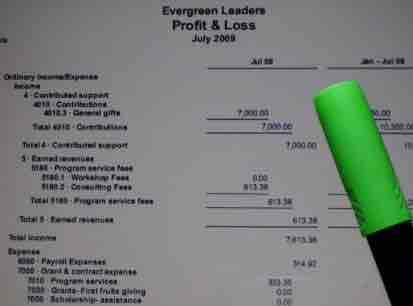

The company's income statement

The income statement shows a company's profit or loss.

An example of revenue is cash received from the sale of products or services. Expenses are the costs involved in producing revenue, such as cash spent to purchase materials or pay bills or employees. If the revenues for a period exceed the expenses for the same period, net income results (Net income = Revenues – Expenses). If expenses exceed revenues for the period, then the result is a net loss.

Accounting Cycle vs. Operating Cycle

Information enters the income statement via the accounting cycle. The accounting cycle is a series of steps performed during the accounting period (some throughout the period, some only at the end of the period) for the purpose of creating the financial statements. This includes analyzing items to determine if they are a business transaction, as well as classifying and recording the transactions as journal entries in the proper journal. After that, the items are posted from the journals to the general ledger, which is used to prepare the financial statements. Companies choose the length of their accounting cycle by how long it takes to carry out the required accounting—not when the individual business transactions take place.

Often, companies have a separate operating cycle for their business. The operating cycle reflects the length of time it takes a company to convert its inventory purchase to sales revenue. A typical operating cycle includes the length of time to convert inventory into a sale, length of time to receive payment from receivables, and length of time to pay the accounts payable.

The length of the operating cycle varies depending on how long inventory, receivable, and payable remain outstanding and may occur several times in one period. It is very rare that the accounting cycle and operating cycle coincide with each other. That is why each business transaction during the operating cycle is analyzed to determine which accounting cycle to record it in. When companies fail to follow this procedure, the current accounting cycle records do not accurately reflect the business transactions in each of the operating cycles. In that case, the financial statements, including the income statement, will not be accurate.

Accrual Basis of Accounting

To allow for the fluctuations in the operating cycle, many companies choose to use the accrual basis of accounting. In accrual accounting, companies recognize revenues when the company makes a sale or performs a service, regardless of when the company receives the cash. However, the matching principle necessitates the preparation of adjusting entries. Adjusting entries are journal entries made at the end of an accounting period, or at any time financial statements are to be prepared, to bring about a proper matching of revenues and expenses.

The matching principle requires that expenses incurred in producing revenues be deducted from the revenues they generated during the accounting period. The matching principle is one of the underlying principles of accounting. This matching of expenses and revenues is necessary for the income statement to present an accurate picture of the profitability of a business.