Accounting Methods

A merchandising company can prepare an accurate income statement, statements of retained earnings, and balance sheets only if its inventory is correctly valued. On the income statement, a company using periodic inventory procedure takes a physical inventory to determine the cost of goods sold. Since the cost of goods sold figure affects the company's net income, it also affects the balance of retained earnings on the statement of retained earnings. On the balance sheet, incorrect inventory amounts affect both the reported ending inventory and retained earnings. Inventories appear on the balance sheet under the heading "Current Assets," which reports current assets in a descending order of liquidity. Because inventories are consumed or converted into cash within a year or one operating cycle, whichever is longer, inventories usually follow cash and receivables on the balance sheet.

FIFO and LIFO methods are accounting techniques used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks. These methods are used to manage assumptions of cost flows related to inventory, stock repurchases (if purchased at different prices), and various other accounting purposes.

LIFO

LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first. Since the 1970s, some U.S. companies shifted towards the use of LIFO, which reduces their income taxes in times of inflation, but with International Financial Reporting Standards banning the use of LIFO, more companies have gone back to FIFO. LIFO is only used in Japan and the United States. The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the "LIFO reserve. " This reserve is essentially the amount by which an entity's taxable income has been deferred by using the LIFO method.

LIFO inventory method

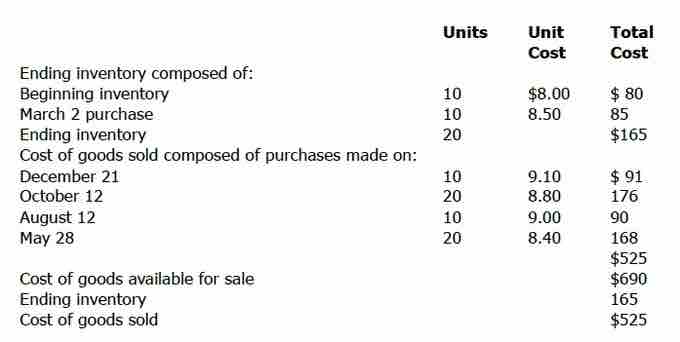

Determining LIFO cost of ending inventory under periodic inventory procedure.

LIFO Flowchart

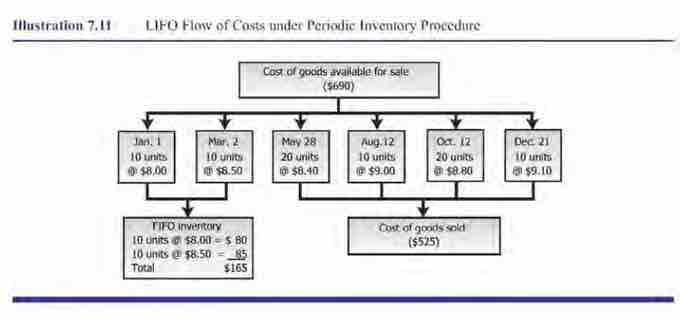

LIFO flow of costs under periodic inventory procedure

The following is an example of the LIFO inventory costing method (assume the following inventory of Product

- Purchase date 10/1/12: 10 units at a cost of USD 5

- Purchase date 10/5/12: 5 units at a cost of USD 6

- On 12/30/12, 11 units of Product

$X$ are sold. When the sale is made, it is assumed that the 5 units purchased on 10/5/12 (the sale eliminates this inventory layer) and 6 units purchased on 10/1/12 were sold.

The ending inventory balance on 12/31/12 balance sheet is

LIFO Under Perpetual Inventory Procedure

Under this procedure, the inventory composition and balance are updated with each purchase and sale. Each time a sale occurs, the items sold are assumed to be the most recent ones acquired. Despite numerous purchases and sales during the year, the ending inventory still includes the units from beginning inventory.

Applying LIFO on a perpetual basis during the accounting period, results in different ending inventory and cost of goods sold figures than applying LIFO only at year-end using periodic inventory procedure. For this reason, if LIFO is applied on a perpetual basis during the period, special inventory adjustments are sometimes necessary at year-end to take full advantage of using LIFO for tax purposes.