Average Cost Method

Under the average cost method, it is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period. The average cost is computed by dividing the total cost of goods available for sale by the total units available for sale. This gives a weighted-average unit cost that is applied to the units in the ending inventory. There are two commonly used average cost methods: Simple Weighted Average Cost method and Moving-Average Cost method.

The following is an example of the weighted average cost method:

- On 12/31/12, Furniture Palace has cost of goods available for sale (beginning inventory and purchases) of USD 5,000; 200 units available for sale; sales of 50 units; and an ending inventory of 150 units.

- The per unit cost of inventory is USD 25 (5,000 / 200 units). The value of the ending inventory on the balance sheet is USD 3,750 (150 units * USD 25). The cost of goods sold on the income statement is USD 1,250 (50 units * USD 25).

Moving Average Cost

Moving-Average (Unit) Cost is a method of calculating Ending Inventory cost. Assume that both Beginning Inventory and Beginning Inventory Cost are known. From them, the Cost per Unit of Beginning Inventory can be calculated. During the year, multiple purchases are made. Each time, purchase costs are added to Beginning Inventory Cost to get Cost of Current Inventory. Similarly, the number of units bought is added to Beginning Inventory to get Current Goods Available for Sale. After each purchase, Cost of Current Inventory is divided by Current Goods Available for Sale to get Current Cost per Unit on Goods.

Also during the year, multiple sales happen. The Current Goods Available for Sale is deducted by the amount of goods sold (COGS), and the Cost of Current Inventory is deducted by the amount of goods sold times the latest (before this sale) Current Cost per Unit on Goods. This deducted amount is added to Cost of Goods Sold. At the end of the year, the last Cost per Unit on Goods, along with a physical count, is used to determine ending inventory cost.

The following is an example of the moving-average cost method:

On 12/29/12, Furniture Palace has beginning inventory of $5,000 and 200 units available for sale. The current cost per unit is

On 12/30/12, a purchase of 50 units is made for $250. The new cost per unit after the purchase is

On 12/31/12, sales for the period were 50 units and ending inventory is 150 units. The value of the ending inventory on the balance sheet is

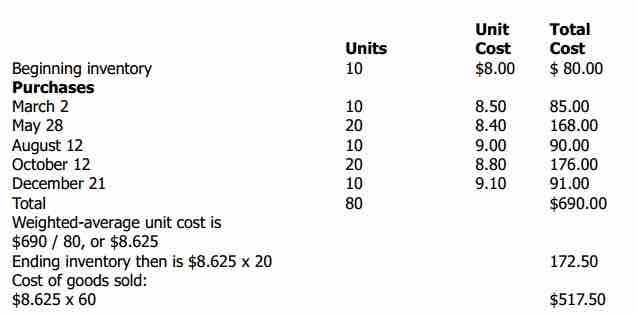

Weighted-Average under Periodic Inventory Procedure

The Weighted-Average Method of inventory costing is a means of costing ending inventory using a weighted-average unit cost. Companies most often use the Weighted-Average Method to determine a cost for units that are basically the same, such as identical games in a toy store or identical electrical tools in a hardware store. Since the units are alike, firms can assign the same unit cost to them. Under periodic inventory procedure, a company determines the average cost at the end of the accounting period by dividing the total units purchased plus those in beginning inventory into total cost of goods available for sale. The ending inventory is carried at this per unit cost.

Advantages and Disadvantages of Weighted-Average Method

When a company uses the Weighted-Average Method and prices are rising, its cost of goods sold is less than that obtained under LIFO, but more than that obtained under FIFO. Inventory is also not as badly understated as under LIFO, but it is not as up-to-date as under FIFO. Weighted-average costing takes a middle-of-the-road approach. A company can manipulate income under the weighted-average costing method by buying or failing to buy goods near year-end. However, the averaging process reduces the effects of buying or not buying.

Determining ending inventory

Determining ending inventory under weighted-average method using periodic inventory procedure