Chapter 7

Controlling and Reporting of Intangible Assets

By Boundless

Intangible assets are identifiable non-monetary assets that cannot be seen, touched, or physically measured.

The valuation of intangible assets are primarily derived from transactions involving intangible assets.

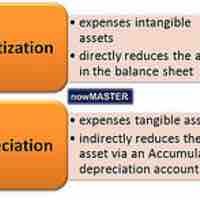

The costs of intangible assets with identifiable useful lives are amortized over their economic/legal life.

A trademark is an intangible asset legally preventing others from using a business's logo, name, or other branding.

A copyright is an amortizable, intangible asset that is used to secure the legal right to publish a work of authorship.

A patent is an amortizable, intangible asset that grants a business the sole right to manufacture and sell an invention.

Goodwill is an intangible asset that equals an acquired company's purchase price minus the value of its net assets when it was acquired.

Franchises and licenses are intangible assets that legally entitle a business to sell a product or service developed by another entity.

Limited-life intangibles are amortized throughout the useful life of the intangible asset using either the units of activity or the straight-line method.

Because Indefinite-life tangibles continue to generate cash they can't be amortized; they must be evaluated for impairment yearly.

Goodwill is an intangible asset that is tested yearly for impairment; it is not amortized.

The primary function of R&D is to develop new products or discover and create new knowledge about scientific and technological topics.

Research and development costs no longer appear as intangible assets on the balance sheet, but as expenses on the income statement.

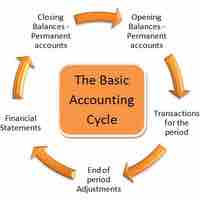

Intangible assets are either recorded at cost or expensed as they are created.

Expense R&D, unless items have alternative future uses, then allocate as consumed, or capitalize and depreciate as used.

Intangibles with identifiable useful lives are amortized on a straight-line basis over their economic or legal life, whichever is shorter.