Failure to Prevent Fraud

Failure to implement adequate internal controls can result in financial statement fraud (purposely misstated financial statements) or embezzlement (theft). This is when the services of a forensic accountant may be necessary. Forensic accounting is the application of accounting methodology to legal issues. It is frequently associated with the investigation of civil or criminal white-collar crime such as fraud, embezzlement, and general abuse of funds issues. Typical tools used in forensic accounting are bank records, personal financial statements, interviews, and credit reports. The forensic accountant's responsibility is to gather and analyze the evidence and deliver clear, accurate, and unbiased reports reflecting the results of the investigation.

Ways to Prevent Fraud

Educate Management

Financial statement fraud involves the intentional publishing of false information in any portion of a financial statement.

To help prevent fraudulent activities, management must implement internal controls/structure, and know what situations to look for. Employees are more likely to commit fraud when under situational or financial pressure, and when the opportunity to commit fraud is present .

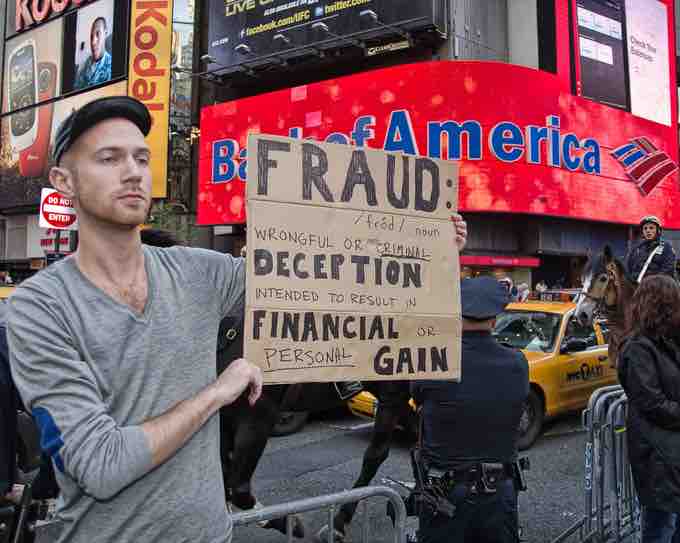

Occupy Wall Street - Fraud

Occupy Wall Street protester with a sign defining fraud.

Separate Accounting Functions

One of the main factors of an effective internal control system is segregation of duties. Management helps to prevent fraud by reducing the incentives of fraud.

One incentive, the opportunity to commit fraud, can be reduced when accounting functions are separated. The act of segregating duties separates the record-keeping, authorization, and review functions in the accounting process. To segregate duties, a company can involve more than one person in the financial statement preparation process. For fraud to occur in this situation, two employees must collude to perpetrate the crime.

Control Environment

A strong control environment (top management control) involves enlisting management to demonstrate ethical behavior. Whatever tone management sets will have a trickle-down effect to the employees. A strong tone is developed by establishing and complying with a written set of policies which are concise and include consequences when procedures are disobeyed. In addition, one of the easiest ways to establish a strong moral tone for an organization is to hire employees with strong ethics/morals.

External Controls

Outside parties performing annual examinations of financial statements can prevent management from committing fraud. To meet financial goals for the company managers may be tempted to "cook the books. " To help prevent management from adjusting financial statements, an independent auditor should examine financial statements on an annual basis.