Federal income tax is levied on the income of individuals or businesses. When the tax is levied on the income of companies, it is often called a corporate tax, corporate income tax or profit tax. Individual income taxes often tax the total income of the individual, while corporate income taxes often tax net income. Taxable income is total income less allowable deductions.

Income is broadly defined. Most business expenses are deductible. Individuals may also deduct a personal allowance and certain personal expenses. These include home mortgage interest, state taxes, contributions to charity, and some other items. Some of these deductions are subject to limits. Capital gains are taxable, and capital losses reduce taxable income only to the extent of gains. Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

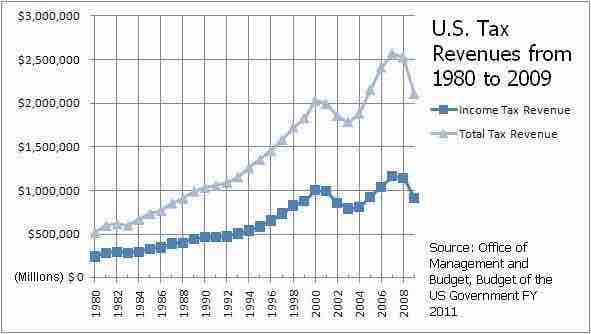

U.S. Income Taxes out of Total Taxes

This graph shows the revenue the U.S. government has made purely from income tax, in relation to all taxes.

In order to help pay for the American Civil War, the federal government imposed its first personal income tax on August 5, 1861 as part of the Revenue Act of 1861. The tax rate was 3 percent of all incomes over $800 ($20,693 in 2011 dollars). This tax was repealed and replaced by another income tax in 1862.

In 1894, Democrats in Congress passed the Wilson-Gorman tariff, which imposed the first peacetime income tax. The rate was 2 percent on income over $4,000 ($107,446.15 in 2011 dollars). This meant fewer than 10 percent of households would pay the tax. The purpose of Wilson-Gorman tariff was to make up for revenue that would be lost by other tariff reductions.

In 1895 the Supreme Court, in Pollock v. Farmers' Loan & Trust Co., ruled that a tax based on receipts from the use of property was unconstitutional. The Court held that taxes on rents from real estate, interest income from personal property, and other income from personal property were treated as direct taxes on property, and had to be apportioned. Since apportionment of income taxes was impractical, this decision effectively prohibited a federal tax on income from property.

In 1913, the Sixteenth Amendment to the Constitution made the income tax a permanent fixture in the U.S. tax system. The United States Supreme Court, in Stanton v. Baltic Mining Co., ruled that the amendment conferred no new power of taxation. They ruled that it simply prevented the courts from taking the power of income taxation from Congress. In fiscal year 1918, annual internal revenue collections for the first time passed the billion-dollar mark, rising to 5.4 billion by 1920. With the advent of World War II, employment increased, as did tax collections—to 7.3 billion. The withholding tax on wages was introduced in 1943 and was instrumental in increasing the number of taxpayers to $60 million and tax collections to $43 billion by 1945.

Taxpayers generally must self-assess income tax by filing tax returns. Advance payments of tax are required in the form of withholding tax or estimated tax payments. Taxes are determined separately by each jurisdiction imposing tax. Due dates and other administrative procedures vary by jurisdiction. April 15 is the due date for individual returns for federal and many state and local returns. Tax, as determined by the taxpayer, may be adjusted by the taxing jurisdiction.

Social Security Tax

The United States social insurance system is funded by a tax similar to an income tax. Social Security tax of 6.2% is imposed on wages paid to employees. The tax is imposed on both the employer and the employee. For 2011 and 2012, the employee tax has been reduced by 6.2% to 4.2%. The maximum amount of wages subject to the tax for 2009, 2010, and 2011 was/is $106,800. This amount is indexed for inflation. A companion Medicare Tax of 1.45% of wages is imposed on employers and employees, with no limitation. A self-employment tax in like amounts (totaling 15.3%, 13.3% for 2011 and 2012) is imposed on self-employed persons.

Payroll Tax

Payroll taxes generally fall into two categories: deductions from an employee's wages and taxes paid by the employer based on the employee's wages. In the United States, payroll taxes are assessed by the federal government, all fifty states, the District of Columbia, and numerous cities. These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers. Most jurisdictions imposing payroll taxes require reporting quarterly and annually in most cases, and electronic reporting is generally required for all but small employers.