Government Debt

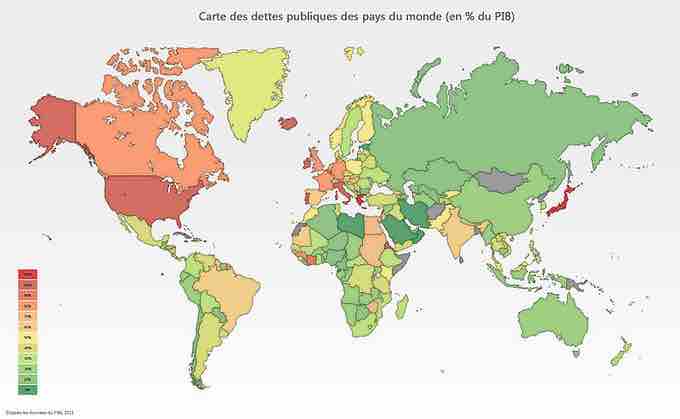

Government debt, also known as public debt, or national debt, is the debt owed by a central government. In the U.S. and other federal states, "government debt" may also refer to the debt of a state or provincial government, municipal or local government. Government debt is one method of financing government operations, but it is not the only method. Governments can also create money to monetize their debts, thereby removing the need to pay interest. However, this practice simply reduces government interest costs rather than truly canceling government debt. shows each country's public debt as a percentage of their GDP in 2011.

Global Public Debt

This map shows each country's public debt as a percentage of their GDP.

Governments usually borrow by issuing securities, government bonds and bills. Less creditworthy countries sometimes borrow directly from a supranational organization (the World Bank) or international financial institutions. As the government draws its income from much of the population, government debt is an indirect debt of the taxpayers. Government debt can be categorized as internal debt (owed to lenders within the country) and external debt (owed to foreign lenders). Sovereign debt usually refers to government debt that has been issued in a foreign currency. A broader definition of government debt may consider all government liabilities, including future pension payments and payments for goods and services the government has contracted but not yet paid.

Government and Sovereign Bonds

A government bond is a bond issued by a national government. Such bonds are often denominated in the country's domestic currency. Most developed country governments are prohibited by law from printing money directly, that function having been relegated to their central banks. However, central banks may buy government bonds in order to finance government spending, thereby monetizing the debt.

Bonds issued by national governments in foreign currencies are normally referred to as sovereign bonds. Investors in sovereign bonds denominated in foreign currency have the additional risk that the issuer may be unable to obtain foreign currency to redeem the bonds.

Denominated in Reserve Currencies

Governments often borrow money in currency in which the demand for debt securities is strong. An advantage of issuing bonds in a currency such as the US dollar, the pound sterling, or the euro is that many investors wish to invest in such bonds.

Risk

Lending to a national government in the country's own sovereign currency is often considered "risk free" and is done at a so-called "risk-free interest rate. " This is because, up to a point, the debt and interest can be repaid by raising tax receipts (either by economic growth or raising tax rates), a reduction in spending, or failing that by simply printing more money. It is widely considered that this would increase inflation and reduce the value of the invested capital. A typical example of this is provided by Weimar Germany of the 1920s which suffered from hyperinflation due to its government's inability to pay the national debt deriving from the costs of World War I.

In practice, the market interest rate tends to be different for debts of different countries. An example is in borrowing by different European Union countries denominated in euros. Even though the currency is the same in each case, the yield required by the market is higher for some countries' debt than for others. This reflects the views of the market on the relative solvency of the various countries and the likelihood that the debt will be repaid.

A politically unstable state is anything but risk-free as it may cease its payments. Another political risk is caused by external threats. It is mostly uncommon for invaders to accept responsibility for the national debt of the annexed state or that of an organization it considered as rebels. For example, all borrowings by the Confederate States of America were left unpaid after the American Civil War. On the other hand, in the modern era, the transition from dictatorship and illegitimate governments to democracy does not automatically free the country of the debt contracted by the former government. Today's highly developed global credit markets would be less likely to lend to a country that negated its previous debt, or might require punishing levels of interest rates that would be unacceptable to the borrower.

U.S. Treasury bonds denominated in U.S. dollars are often considered "risk free" in the U.S. This disregards the risk to foreign purchasers of depreciation in the dollar relative to the lender's currency. In addition, a risk-free status implicitly assumes the stability of the US government and its ability to continue repayments during any financial crisis.

Lending to a national government in a currency other than its own does not give the same confidence in the ability to repay, but this may be offset by reducing the exchange rate risk to foreign lenders. Usually small states with volatile economies have most of their national debt in foreign currency.