Profit Maximization Pricing

Profit maximization is the short run or long run process by which a firm determines the price and output level that returns the greatest profit. Any costs incurred by a firm may be classed into two groups: fixed costs and variable costs.

Fixed costs, which occur only in the short run, are incurred by the business at any level of output, including zero output. These may include equipment maintenance, rent, wages of employees whose numbers cannot be increased or decreased in the short run, and general upkeep.

Variable costs change with the level of output, increasing as more product is generated. Materials consumed during production often have the largest impact on this category, which also includes the wages of employees who can be hired and laid off in the span of time (long run or short run) under consideration.

Fixed cost and variable cost, combined, equal total cost. Revenue is the amount of money that a company receives from its normal business activities, usually from the sale of goods and services (as opposed to monies from security sales such as equity shares or debt issuances).To obtain the profit maximising output quantity, we start by recognizing that profit is equal to total revenue (TR) minus total cost (TC).

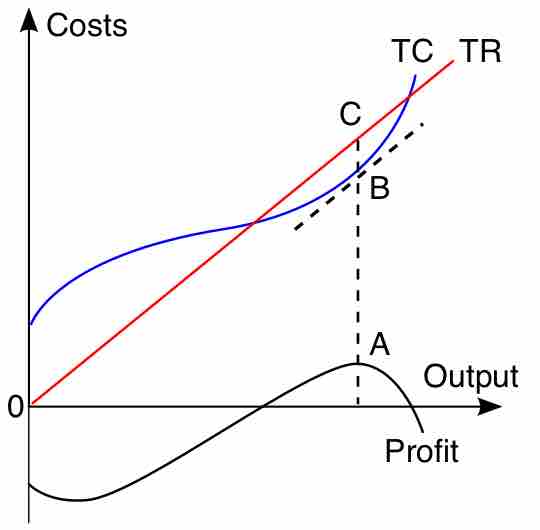

Given a table of costs and revenues at each quantity, we can either compute equations or plot the data directly on a graph.

Total Profit Maximization

This linear total revenue curve represents the case in which the firm is a perfect competitor in the goods market, and thus cannot set its own selling price.

The profit-maximizing output is the one at which this difference reaches its maximum. In the accompanying diagram, the linear total revenue curve represents the case in which the firm is a perfect competitor in the goods market and thus cannot set its own selling price. The profit-maximizing output level is represented as the one at which total revenue is the height of C and total cost is the height of B; the maximal profit is measured as CB. This output level is also the one at which the total profit curve is at its maximum.

If, contrary to what is assumed in the graph, the firm is not a perfect competitor in the output market, the price to sell the product at can be read off the demand curve at the firm's optimal quantity of output. The above method takes the perspective of total revenue and total cost. A firm may also take the perspective of marginal revenue and marginal cost, which is based on the fact that total profit reaches its maximum point where marginal revenue equals marginal cost.